Your partner in private markets

Client-centric. Results-driven.

The Bite edge

Operating countries; UK, USA, Hong Kong, Cayman Islands, Australia

Team of high achievers across key global jurisdictions

Countries we have clients in

Assets under advisement

Fund selection

We offer a private markets funds and direct deals designed for wealth management clients and high net worth individuals. Our goal is to deliver optimal risk-adjusted returns, diversification, and long-term value through a careful and thorough fund selection process.

We prioritise integrity, transparency, and a client-focused approach, building strong partnerships to help our clients meet their investment goals. We also incorporate ESG principles into our practices.

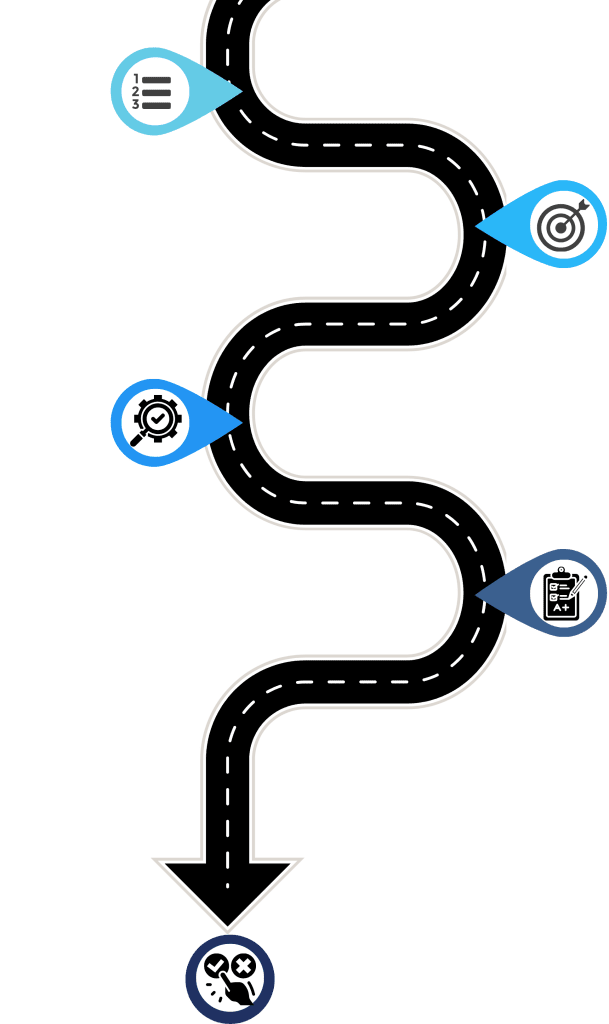

Our investment process

Our dedicated investment team undertakes a rigorous investment selection process.

This methodical approach involves several crucial steps:

1. Monitoring top tier managers

We maintain an ongoing assessment of several top-tier managers, continuously monitoring and tracking their performance.

2. Opportunity identification

Our research team actively monitors the investment landscape, identifying opportunities that align with our company’s strategic objectives.

3. Due dilligence

Thorough due dilligence is conducted by our research team in collaboration with the investment committee. This comprehensive analysis ensures a meticulous evaluation of potential investments.

4. Investment assessment

The investment committee critically assesses the quality and viability of each investment opportunity, employing a rigorous evaluation process.

5. Investment decision

The decision to invest lies with you. Leveraging our digital platform, you have the autonomy to make informed investment decisions tailored to your preferences.

Meet our team

Our team of seasoned professionals leads a rigorous evaluation of investment prospects. Drawing from their extensive experience, our investment committee has advised on over $13 billion in capital raises and directed commitments exceeding $4.5 billion across private equity, private credit, and real assets.

Where you can find us

Discover Bite's alternative investment solutions tailored to cater to a diverse global investor base. With strategically located offices across six key regions in the US, Europe, and Asia, our team fosters close collaboration with stakeholders in critical jurisdictions, supporting our global reach.

Frequently asked questions

At Bite Asset Management, our investment strategy is designed to deliver optimal risk-adjusted returns and long-term value while maintaining a commitment to Environmental, Social, and Governance (ESG) principles. We are industry and geography agnostic, enabling us to offer diversified portfolio solutions tailored to our clients’ unique objectives.

Our approach includes continuous monitoring and evaluation of top-tier managers, active identification of strategic investment opportunities, and rigorous due diligence. Our seasoned investment committee critically assesses the quality and viability of each opportunity, ensuring alignment with our high standards. Through our state-of-the-art digital platform, we empower investors to make informed decisions, backed by comprehensive research and our unwavering dedication to integrity, transparency, and client success.

We offer access to a diverse range of private asset classes. As an industry and geography agnostic firm, Bite Asset Management funds uniquely provide opportunities across various sectors and markets and you can also connect with other investment firms via our digital hub, Bite Wealth Universe. This includes private equity, private debt, real estate, infrastructure, and other alternative investments. Our goal is to help you build a diversified portfolio tailored to your investment objectives.

Bite Asset Management holds regulatory licenses in multiple jurisdictions, including the USA (FINRA), Hong Kong (SFC), Cayman Islands (CIMA), and Australia (AFS). These licenses enable us to serve clients globally, ensuring compliance with local regulations and providing a secure and trustworthy investment experience. However, specific investment opportunities may be subject to local laws and regulations, so we recommend consulting with our team or your legal advisor to confirm eligibility based on your country of residence.

Yes, you can arrange to speak with our experts in person. We have offices in London, New York, Hong Kong, and Singapore, and our team frequently travels. Please get in touch at with us ([email protected]) to arrange a meeting at one of our offices or to see if we can coordinate a meeting in your location.

The best way to contact us is through our contact form or via email at [email protected]. Additionally, you can follow us on LinkedIn and YouTube for the latest updates and insights. We are committed to providing personalized support and are happy to assist you with any inquiries.

We are always looking for talented individuals to join our team. If you are interested in career opportunities at Bite Asset Management, please email your resume and cover letter to [email protected]. We look forward to hearing from you and exploring how you can contribute to our dynamic team.

Do you have any further questions? Contact us