- The asset class has experienced huge growth over the last decade, now representing a significant part of the private markets

- Companies are now increasingly choosing private lenders over banks to finance debt, a trend which appears to have rapidly increased since 2008

- There are numerous, flexible private credit strategies to suit a host of different economic climates

- Most recently, private credit has shown a resilient performance on a risk-adjusted basis vs public market equivalents

The remarkable rise of private credit

When considering investing in the private markets, an area which does not gain as much attention as the much-lauded private equity scene is private credit. Also known as private debt, this ever-growing asset class has quickly become more prominent and now boasts of having assets under management (AUM) of approximately USD1.2 trillion1 following a decade of exponential growth.

Before we look at the case for investing in private credit, let’s first start by defining what exactly private credit is. According to Preqin2, private credit or private debt, is “the investment of capital to acquire the debt of companies (as opposed to acquiring equity).” The asset class is not available on the public market, but private debt is available to both listed and private companies alike as well as real assets such as real estate and infrastructure.

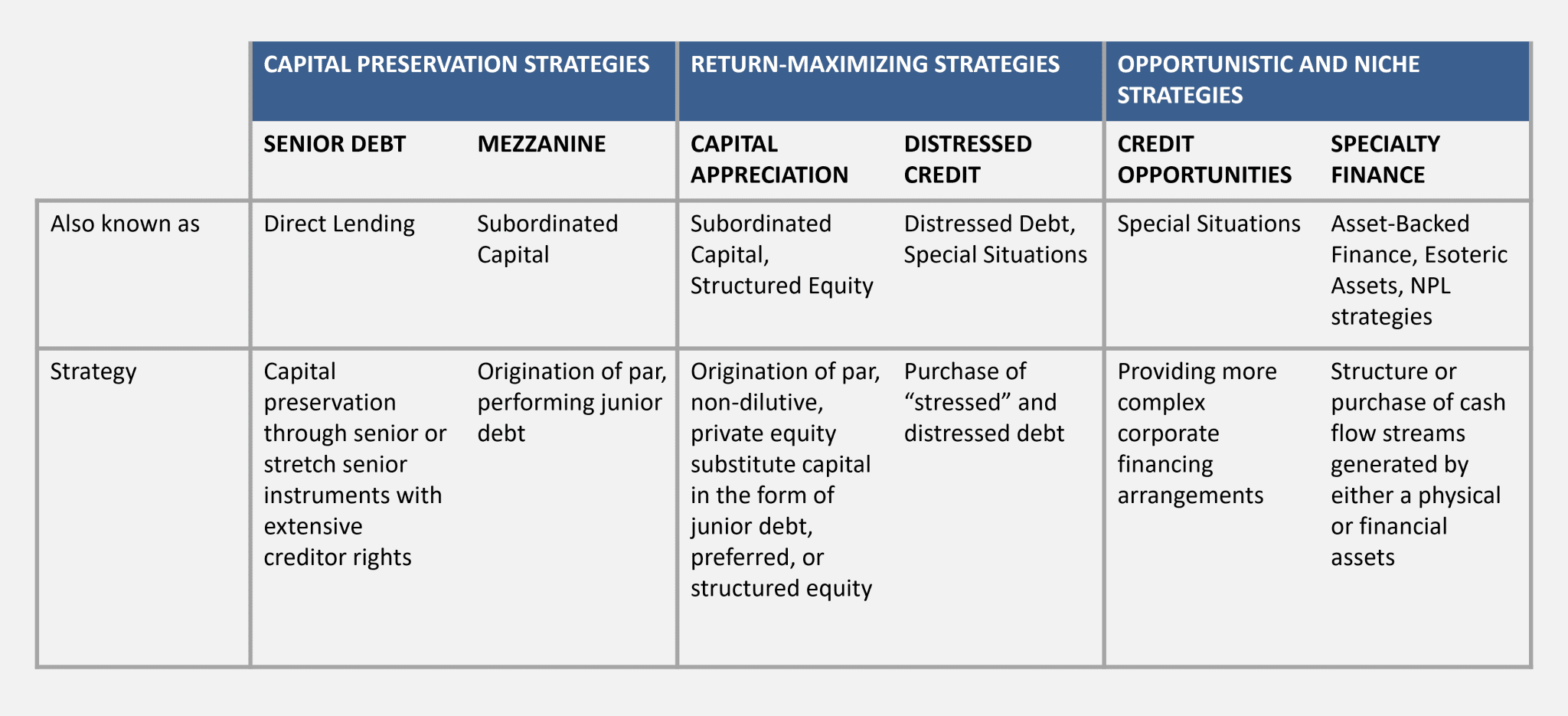

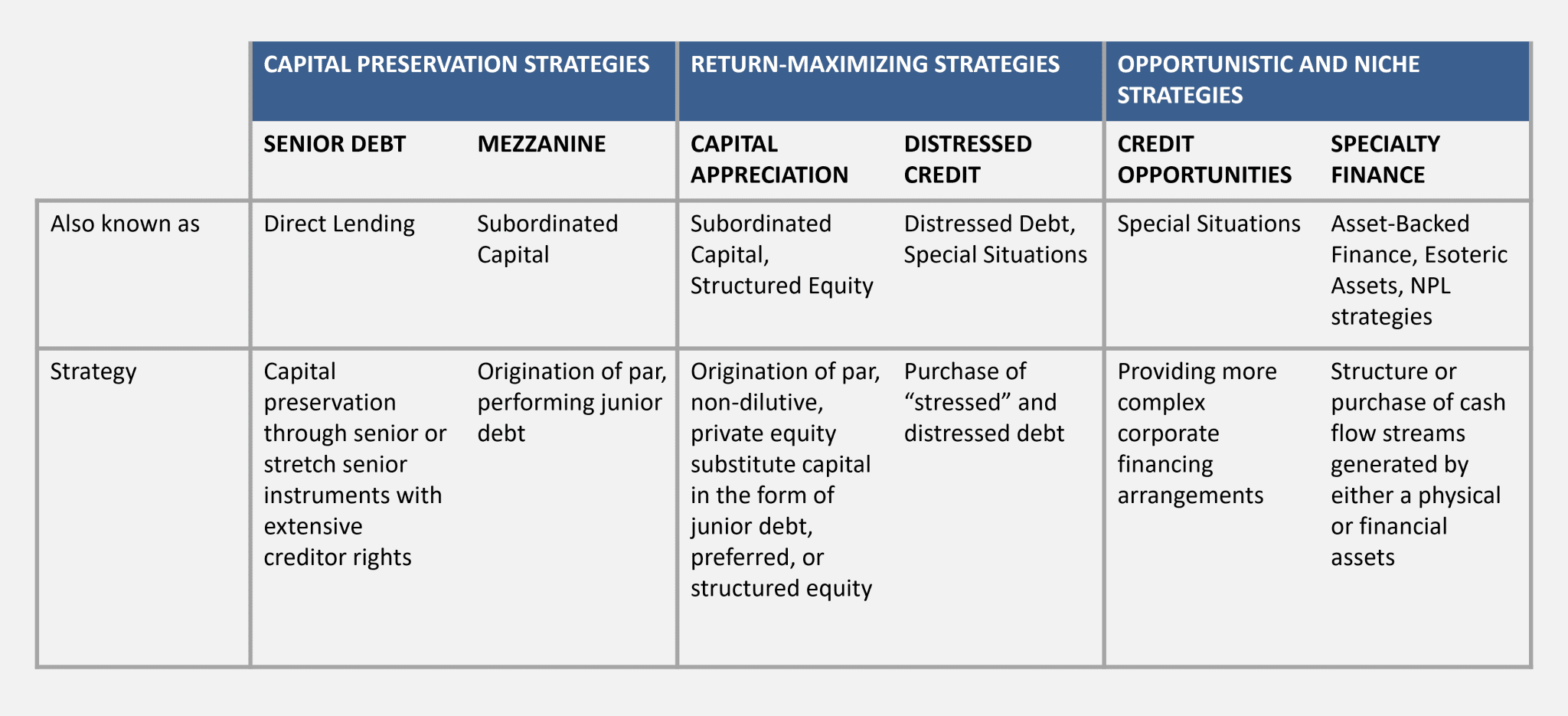

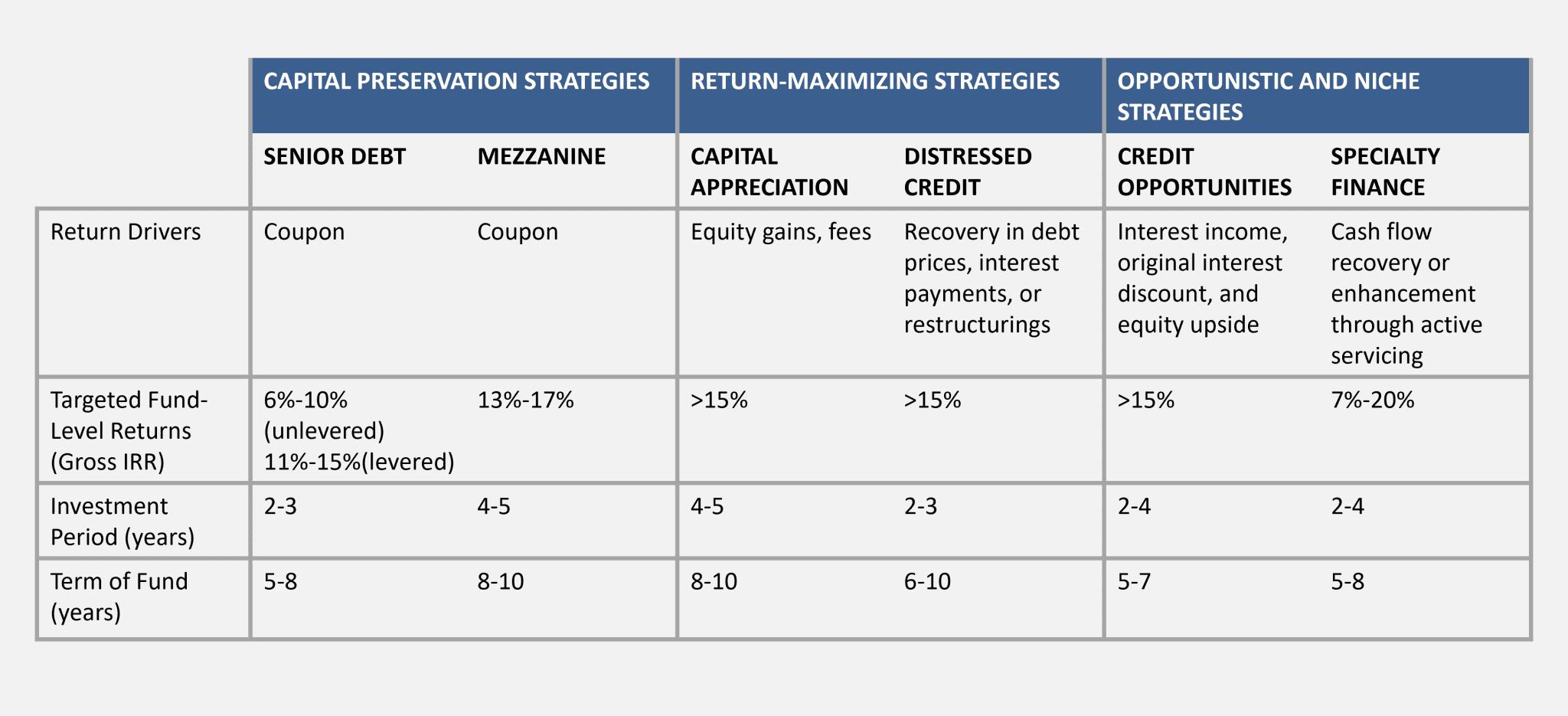

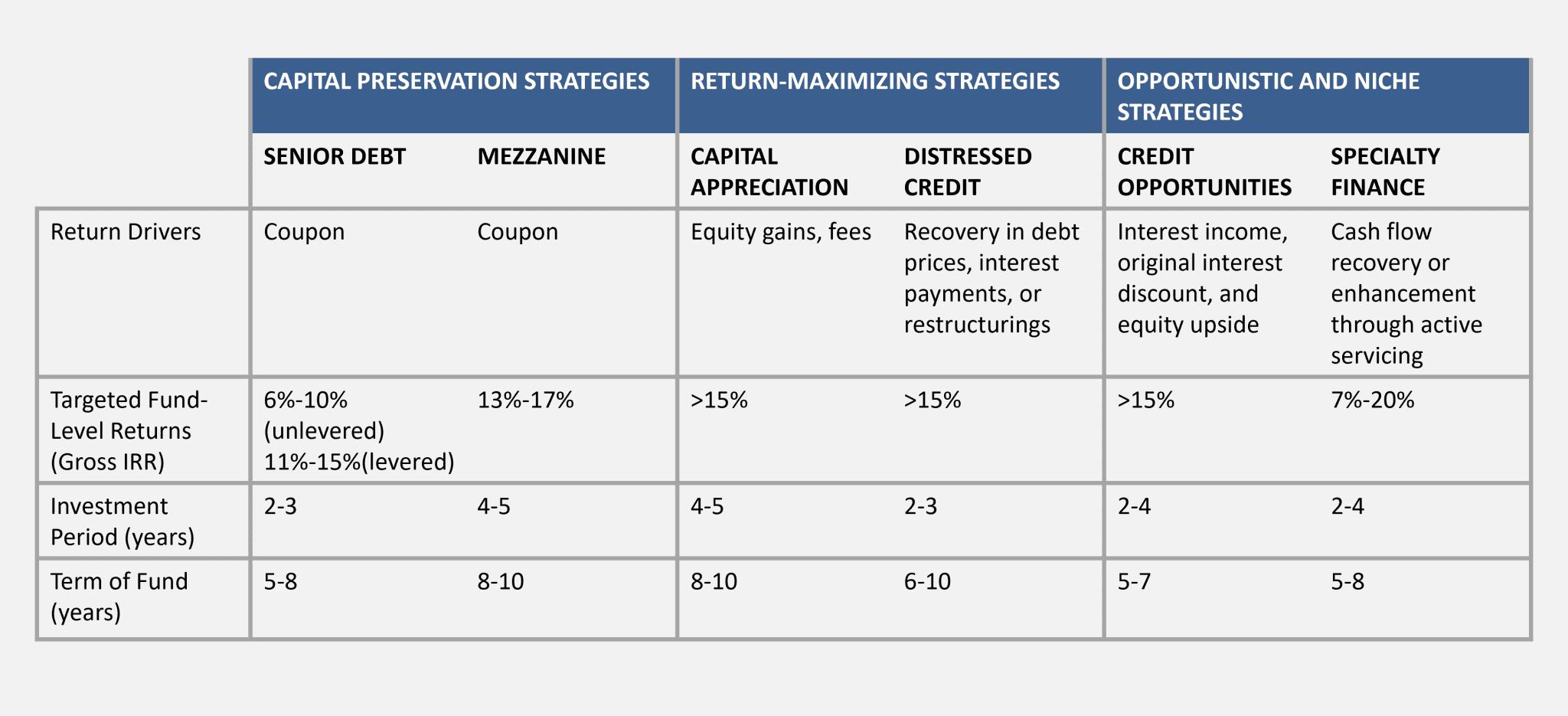

There are many strategies and types of private credit to consider depending on your investment portfolio goals. Shown in Figure 1 below, these private credit strategies include:

- Those aiming to preserve capital – Senior Debt and Mezzanine strategies

- More aggressive tactics intended to maximise returns offering premium yields with an increased credit risk – Capital Appreciation and Distressed Capital strategies

- Additional opportunistic / niche strategies – Credit Opportunities and Specialty Finance strategies – which are well worth a second look should an opportunity present itself.

Figure 1: Characteristics of private credit strategies3

Cambridge Associates, Private Credit Strategies: An Introduction

Although private credit has been a feature of the private markets since the early 1990s, the asset class exploded following the Global Financial Crisis of 2008 when tighter regulation was placed upon banks which, in turn, led to more banks choosing to reduce their exposure to the more perceived riskier credit loans. Fast forward to over a decade later, the private credit industry has grown rapidly morphing into an asset class with over USD 1 trillion AUM, accounting for 10-15% of the overall AUM of private markets.4

Challenging the status quo: Why companies are now looking to private lenders over established banks

Throughout the last decade, we have seen an increased appetite from companies seeking private lenders to help finance debt due to the reported potential benefits compared to the more traditional and well-trodden route of dealing with established banks.5 This article runs through the benefits associated with private lenders.

Firstly, market conditions are likely to increase interest in private credit funds due to the current turbulence of the public markets. The cost for a company to seek private debt is becoming closer to public equivalents with investors favouring some of the potential benefits associated with private markets. For example, with private markets, investors only need to deal with one or two lenders (it can be up to 10 for public lenders), leading to a more effective communication process when seeking, for example, term amendments, requiring urgent support or looking to capitalise on a time-sensitive opportunity.

Likewise, and especially in today’s economic climate, companies may well decide it’s actually worth paying more to seek finance from a private investment firm who, unlike banks, generally have more flexible lending terms and often greater capacity and internal resources for businesses to tap into and ultimately help navigate challenging times. An important example of this would be private lenders’ ability to offer undrawn facilities to help fund potential acquisitions. This can often be as much as a third of the original loan which is something that would be incredibly difficult to achieve in the public markets.

Lastly, privacy is another crucial factor to consider when choosing between private vs. public debt solutions. When opting for the public route, companies usually work with a consortium of banks (as opposed to a single private credit firm) to assist with funding future acquisition opportunities. But with a larger group of stakeholders, there is a greater chance for the news to leak, which could potentially jeopardise any deal completion.

Clearly a compelling option for companies, but why invest in private credit?

Continuing on from the previous section, it’s clear more companies are now considering private credit due to the potential benefits on offer. This has now created a wider pool of quality businesses offering attractive opportunities for investors to choose from. But how do investors know they are accessing the most attractive companies and what are the benefits of private market investing? With the experience in finding and forming deep-rooted relationships with suitable businesses, private credit firms are, in my opinion, well-placed to select opportunities with sound companies, always striving to generate the best possible returns for their investors as a result.

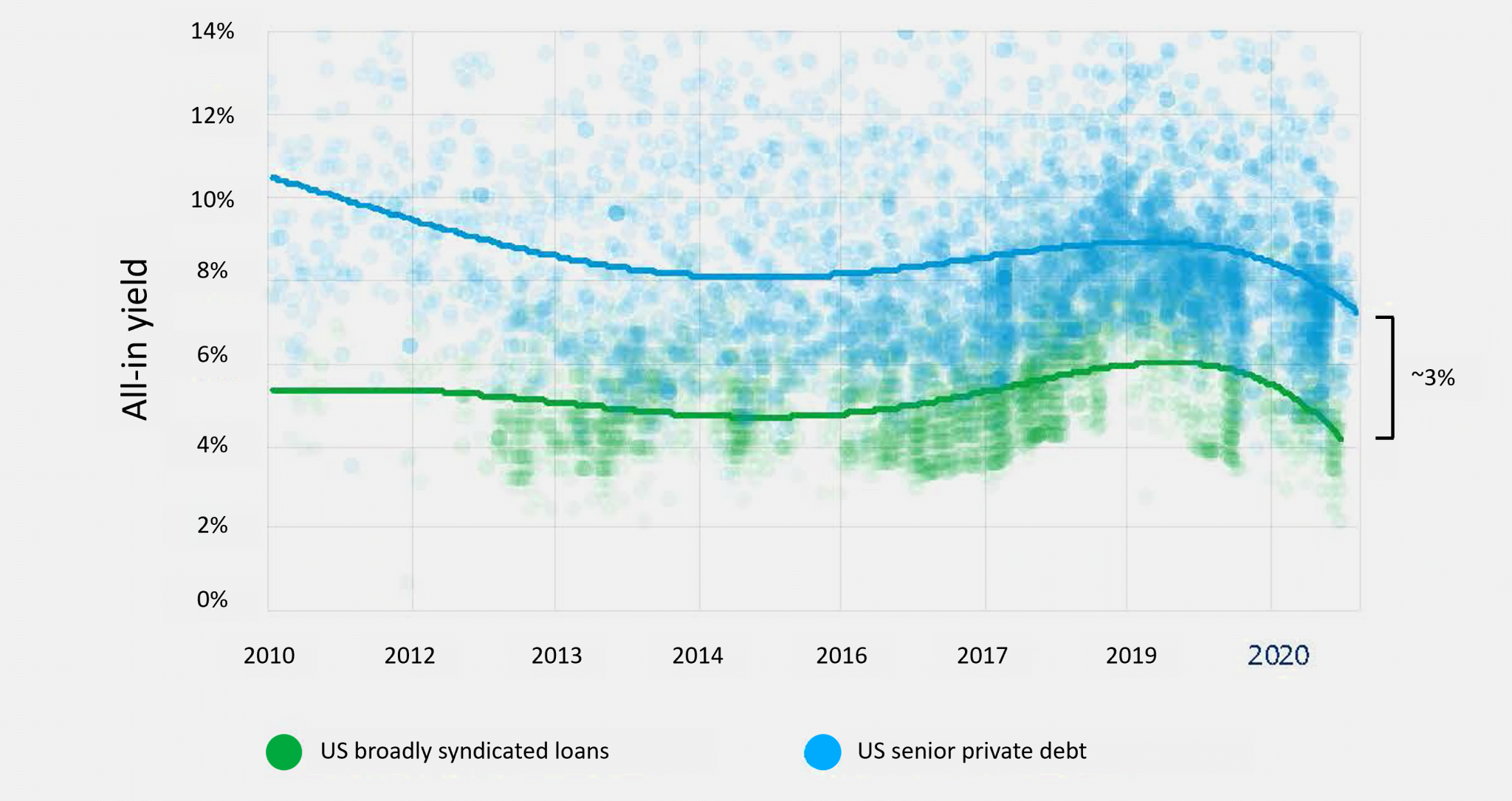

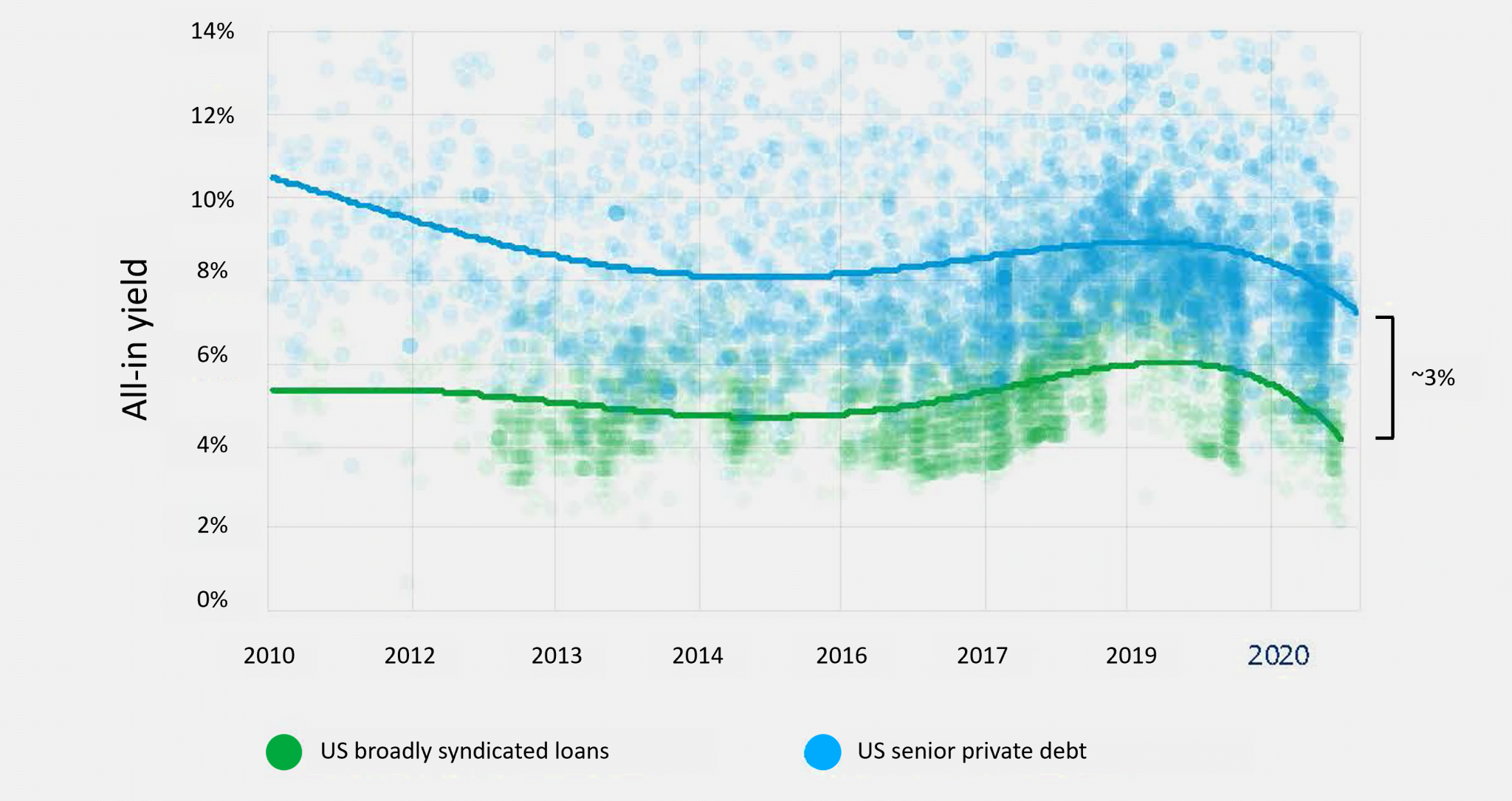

Perhaps one of the most compelling reasons for investing in private credit is the generally higher yields on offer in comparison to the liquid public alternatives. As we can see in Figure 2 below, Mercer (an asset management firm) reported a consistent outperformance of US senior private debt compared to syndicated loans between 2010-2020.

Figure 2: All-in yield at entry – US senior private debt versus US broadly syndicated loans6

This outperformance is on the one hand attributed to being able to attract higher quality borrowers, who are often attracted to private credit lenders for the potential benefits they offer vs. public markets and banks, such as the ability to move swiftly and fast, without requiring time-consuming roadshows or lengthy syndicate negotiations. On the other hand, a private lender is also able to support businesses at the board level, as many firms have adjacent private equity teams, experienced in value creation and supporting management teams.

This can also help to explain the typically lower default rates of private credit. For example, we know that the overwhelming majority of public bonds (around 95%) are unsecured (i.e. not backed by assets to repay debts in a default situation) but private debt loans tend to be secured and because of the reduced risk for investors, recovery value for private assets tend to be approximately 30% higher than public market equivalents.7

It’s worth noting, that it’s not only high yields at play here but a number of additional opportunities to increase total returns. This leads us onto an important point when considering investing in private credit; investors need to know what numbers they should be looking for when evaluating the upside of private credit. For example, high yield often generates a 7% return but the total return of private credit investments can be anywhere between 11-16% depending on market conditions. But where is this upside coming from?

Figure 3: Characteristics of private credit strategies8

Cambridge Associates, Private Credit Strategies: An Introduction

It’s important for investors to have good knowledge of the unique way these transactions are structured. As highlighted in Figure 3, there can be an equity upside to the deals in the form of PIK, warrants and equity kickers.

Another metric often misunderstood by investors when evaluating private credit investments is Net Asset Value (NAV). Simply put, NAV is calculated as “Beginning NAV + Change in fair value – Distributions = Ending NAV.” In volatile periods, valuation policies benchmarking private debt to public equivalents results in a decreasing NAV, which can be misleading. Distributions which are cash back to the investor also decrease NAV, but actually increase the investor’s return. Therefore, the lesson here is that a decreasing NAV in credit does not necessarily mean that the investor’s return will be impacted, or that the credit itself is impaired. An often more reliable metric to look at to measure anticipated return to an investor is the total return that includes both capital appreciation as well as income distributions. Please note, investors should ensure they understand all the information about a structure before making a decision to invest.

Given the range of private credit opportunities now flooding into private markets, it’s perhaps no surprise to see private credit forming an integral part of an increasing number of portfolios as investors refine and adapt strategies throughout different economic cycles. Indeed, a recent report from McKinsey9 discovered this was the only asset class to show consistent fundraising growth every year, even through the pandemic.

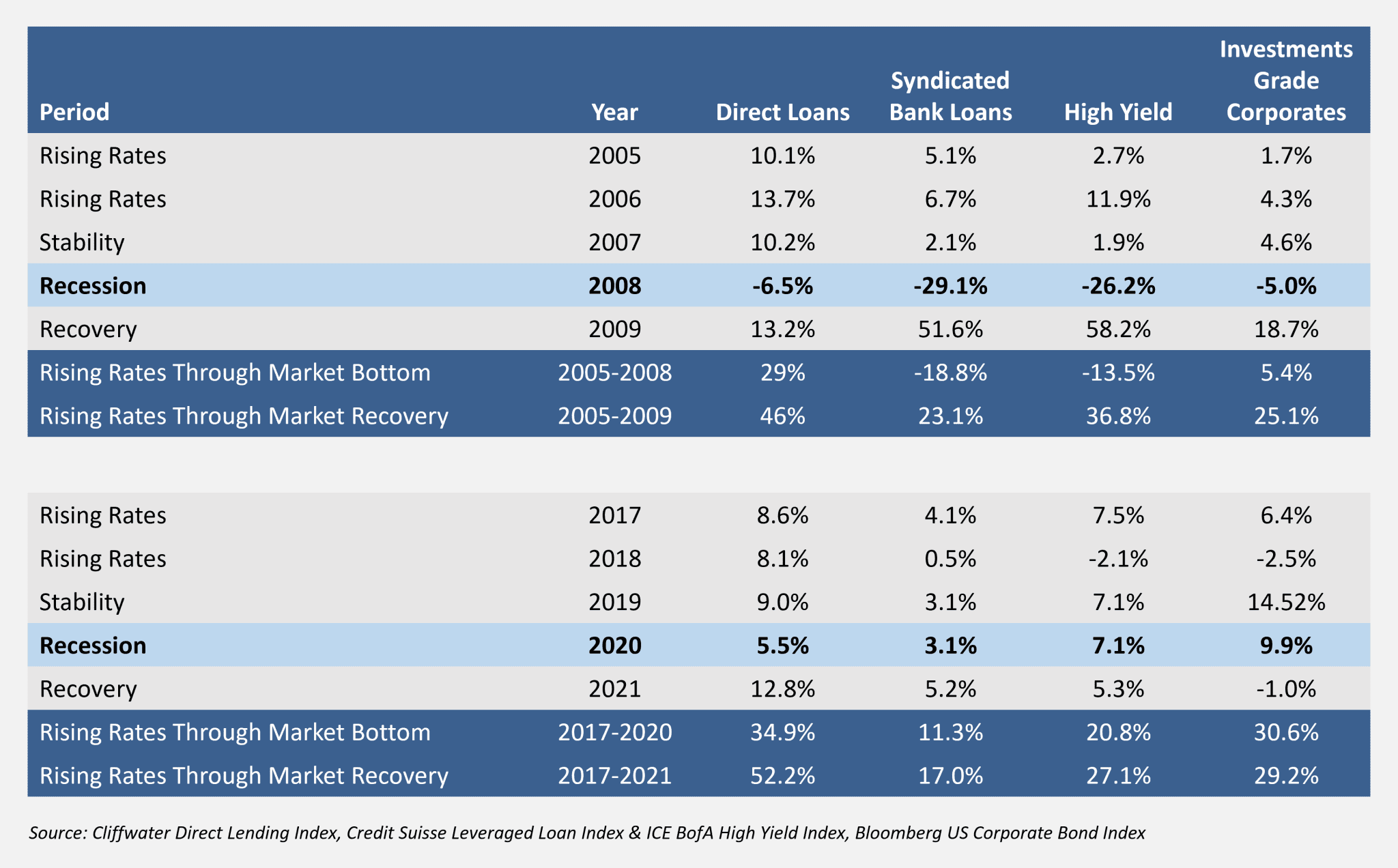

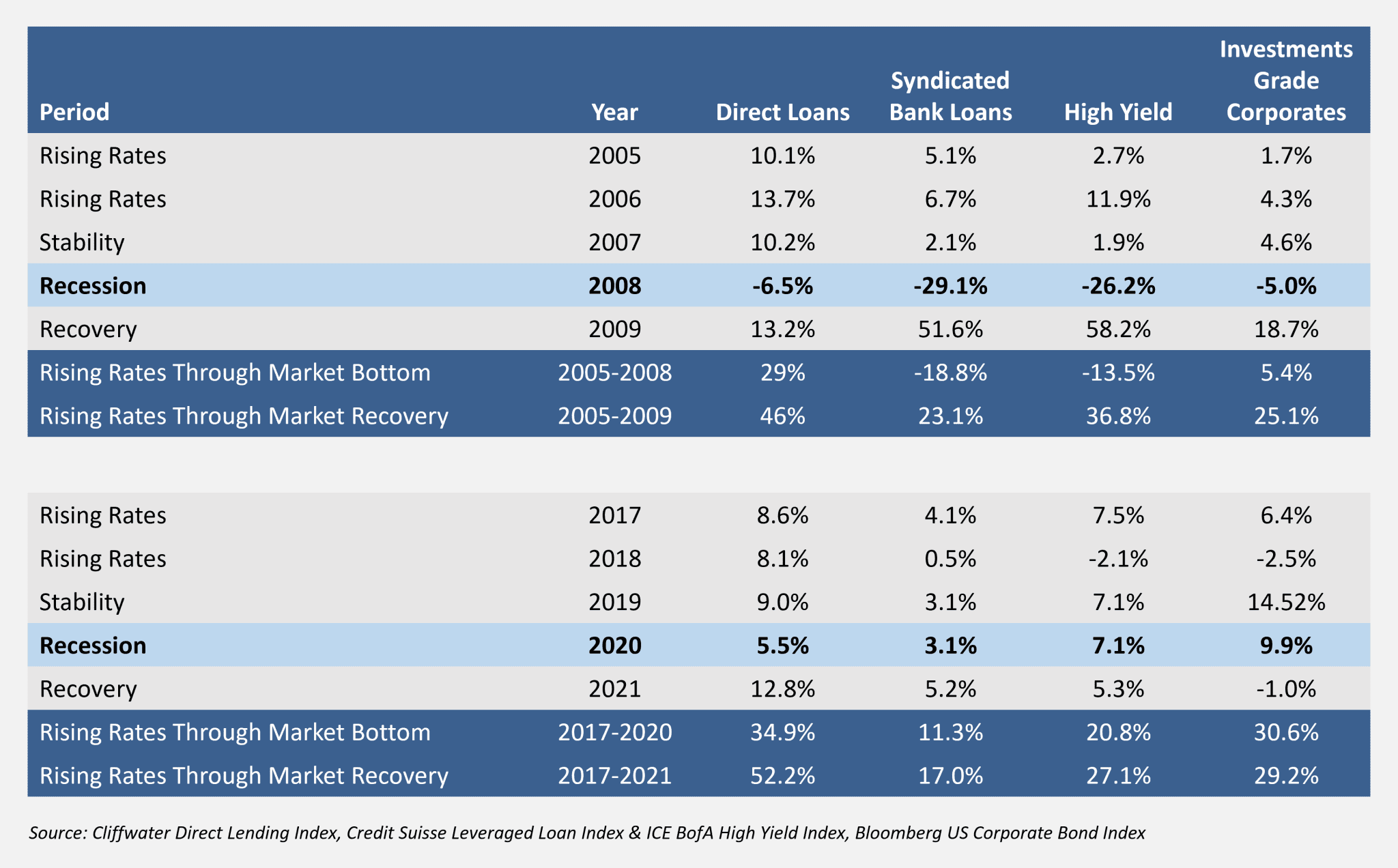

Figure 4 looks at this trend further, highlighting the asset class’ outperformance compared to public alternatives during the two most recent interest rate hiking cycles and subsequent recessions.

Figure 4: Total returns of selected credit investments during interest rate hiking cycles and subsequent recessions and recoveries10

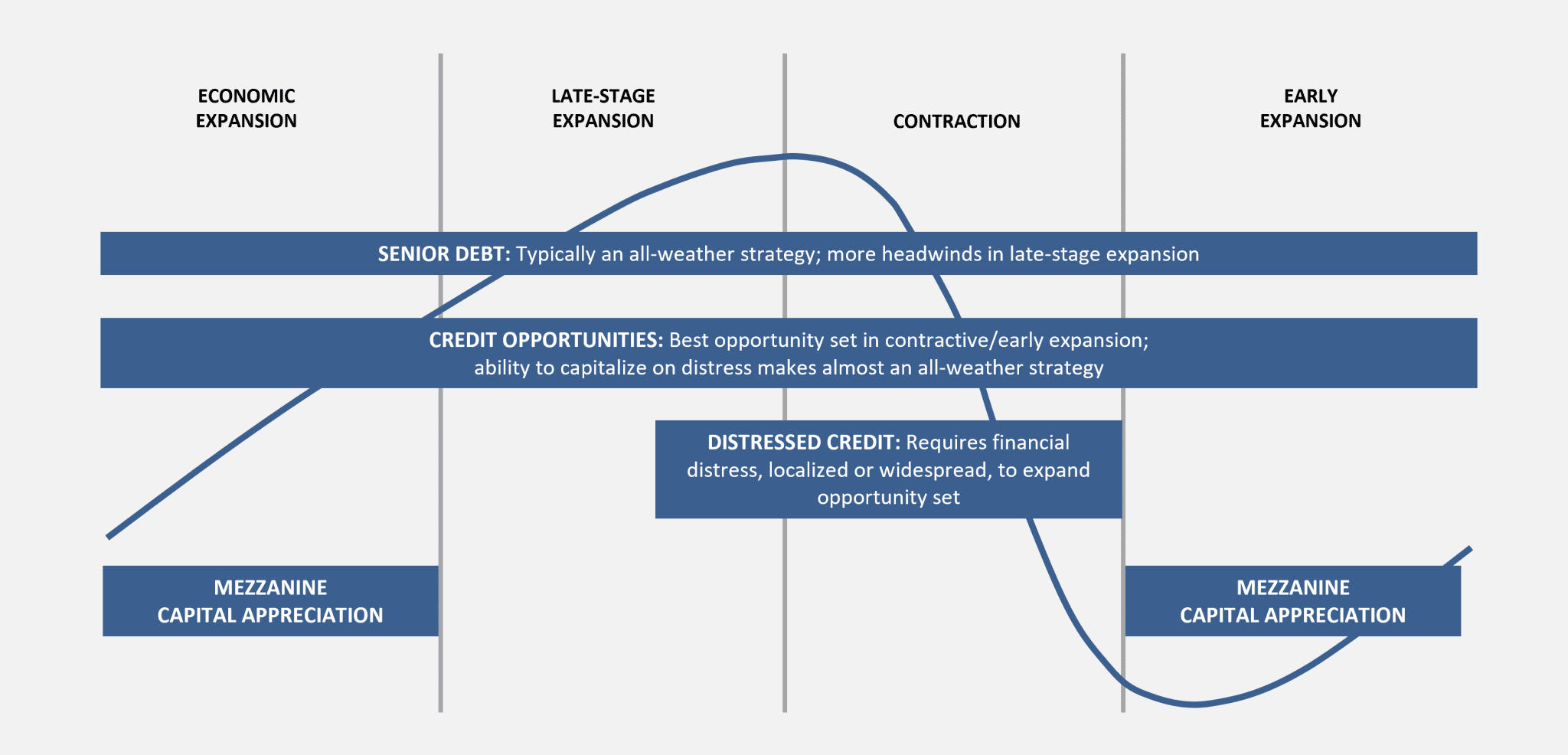

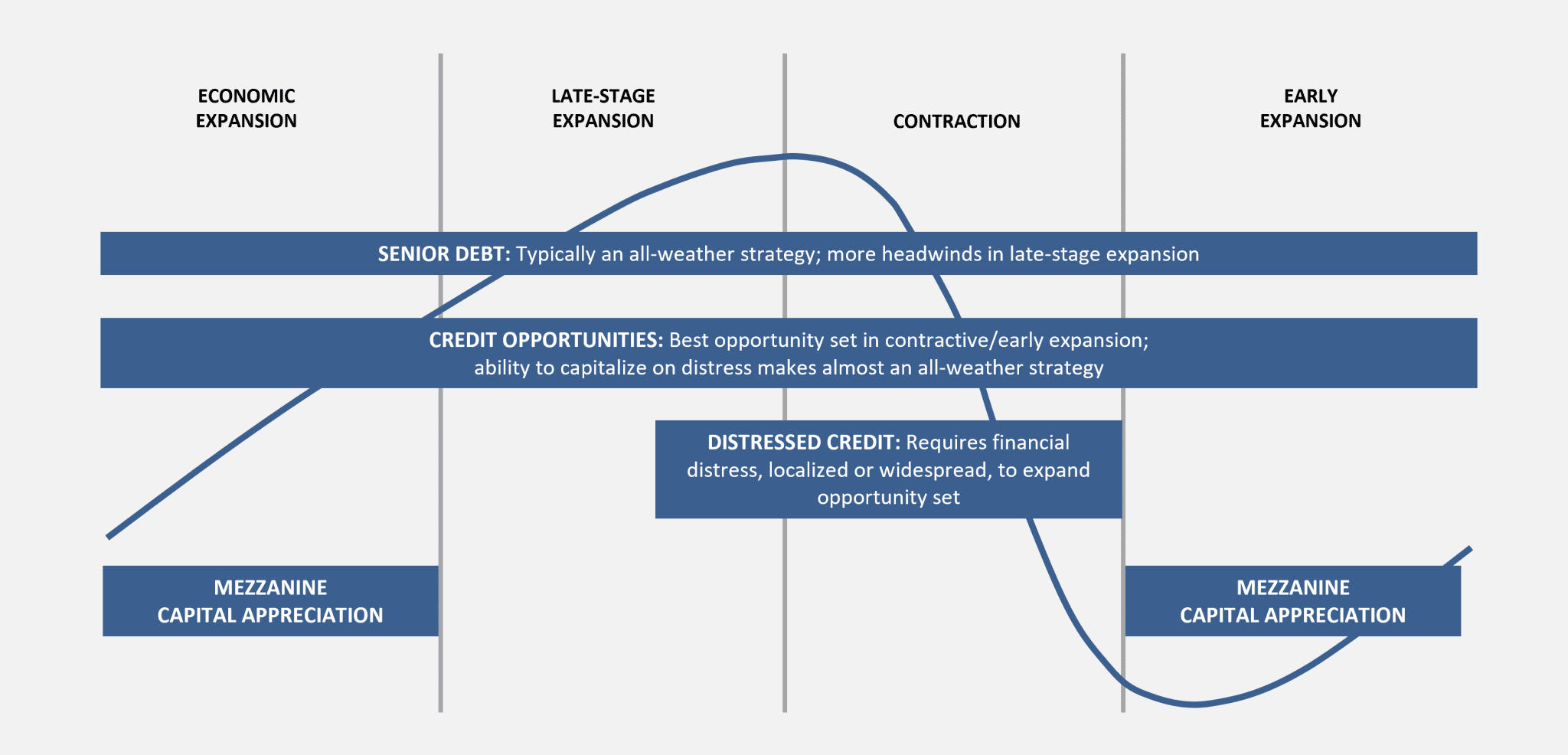

However, whether it’s identifying capital appreciation opportunities with companies looking to expand or targeting a distressed credit opportunity during a downturn, there really is something for everyone in this asset class, as we can see from Figure 5.

Figure 5: Private credit strategies across the economic cycle11

Cambridge Associates, Private Credit Strategies: An Introduction

Accessing private credit opportunities

The good news for investors is that this once-daunting asset class is no longer reserved for only the ‘giants’ of the investment community, with high-net-worth individuals, as well as smaller family offices and wealth managers all benefiting from increased access to the private markets in recent years.

It can, therefore, come as no surprise that the rapid growth of private credit we have witnessed over the last decade is predicted to continue for the foreseeable future with the asset class’ AUM expected to more than double to USD2.69 trillion12 by 2026. Driven by increased demand from companies and investors alike, it’s likely that this asset class is here to stay and will play an increasingly important role within an ever-growing number of investors’ private market portfolios.

Sources:

2. Preqin, ”Private Debt” (accessed September 2022)

3. Cambridge Associates, ”Private Credit Strategies: An Introduction”, September 2017

4. PitchBook, ”What is private debt?”, 12 October 2021

5. J. Guilford, N. Unmack, ”Breakdown: Private credit’s main threat is itself”, Reuters, 7 July 2022

6. Mercer, ”Private debt: Why more investors are turning to the asset class now”, February 2022

7. M. Zangerl, ”Public versus private debt: what’s-the-difference?”, Abrdn, 11 December 2019

8. Cambridge Associates, ”Private Credit Strategies: An Introduction”, September 2017

9. McKinsey & Company, ”Private markets rally to new heights”, March 2022

10. ARES, ”Private credit: Differentiated performance in the midst of rising interest rates”, July 2022

11. Cambridge Associates, ”Private Credit Strategies: An Introduction”, September 2017

12. Private Equity Wire, ”Private Debt AUM Set to double to USD2.69 trillion by 2026, says Preqin”, 17 January 2022

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Asset Management. The facts of this article are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Asset Management delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Asset Management, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect.

This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.