Tap into the potential of private markets

Private markets have a proven track record of delivering superior returns with lower volatility compared to public markets. Seize the opportunity to expand your capital through direct investments, co-investment opportunities, and diversified funds.

Private markets performance

The idea of a privately held company often conjures up images of small businesses. However, as referenced within our specialist article “Staying private for longer” not all privately held companies are small; in fact, most of the economy is private. According to Forbes, less than one percent of the 27 million companies in the United States are publicly traded.

For those looking to tap into this asset class, the good news is that private markets have become increasingly accessible and are no longer exclusively reserved for established institutional players. This has fueled the remarkable growth private markets have experienced since the start of the 21st century, to the point where ‘alternative’ investments may not be so alternative anymore.

In fact, large asset managers such as BlackRock, Goldman Sachs, Morgan Stanley, and others are now recommending a sizeable inclusion of private markets in investor portfolios. They argue that investors risk missing out on a key return component and potentially failing to meet their investment objectives by not including private markets in their diversified portfolios.*

Optimize your investment journey

Browse our commingled private markets portfolios

Select your own investments

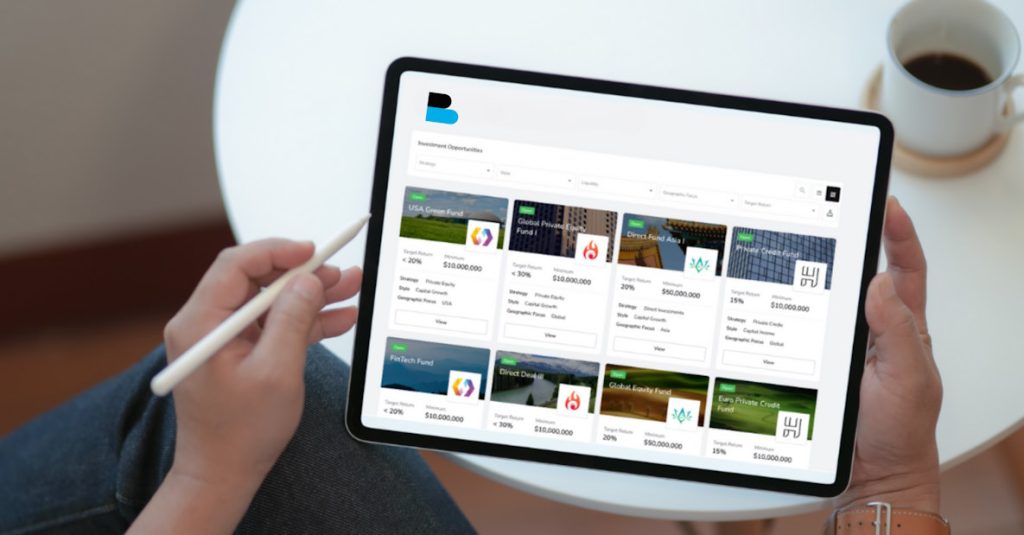

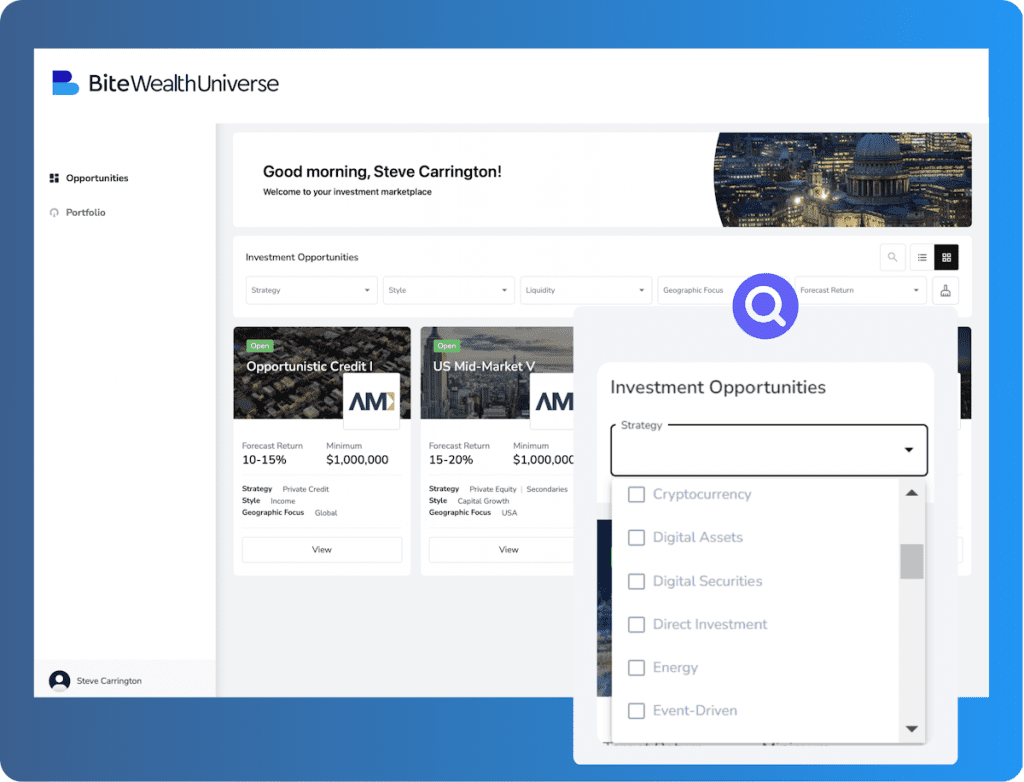

Are you a professional investor or manager? Enhance your client experience with our our award-winning white-labelled intuitive digital marketplace, powered by Bite Stream and our wealth management ecosystem.

Our investment solutions

We provide clients with turnkey portfolios offering hassle-free access to diversified private markets investments, designed to meet clients’ portfolio objectives and risk preferences.

Investors have the possibility to choose between capital appreciation focused funds, diversified across all four key private markets strategies globally, as well as yield generation focused funds, distributing income quarterly. These are flexible evergreen structures, offering quarterly subscriptions and redemptions.

Capital appreciation

Income generation

Diversification

Flexible, evergreen structure

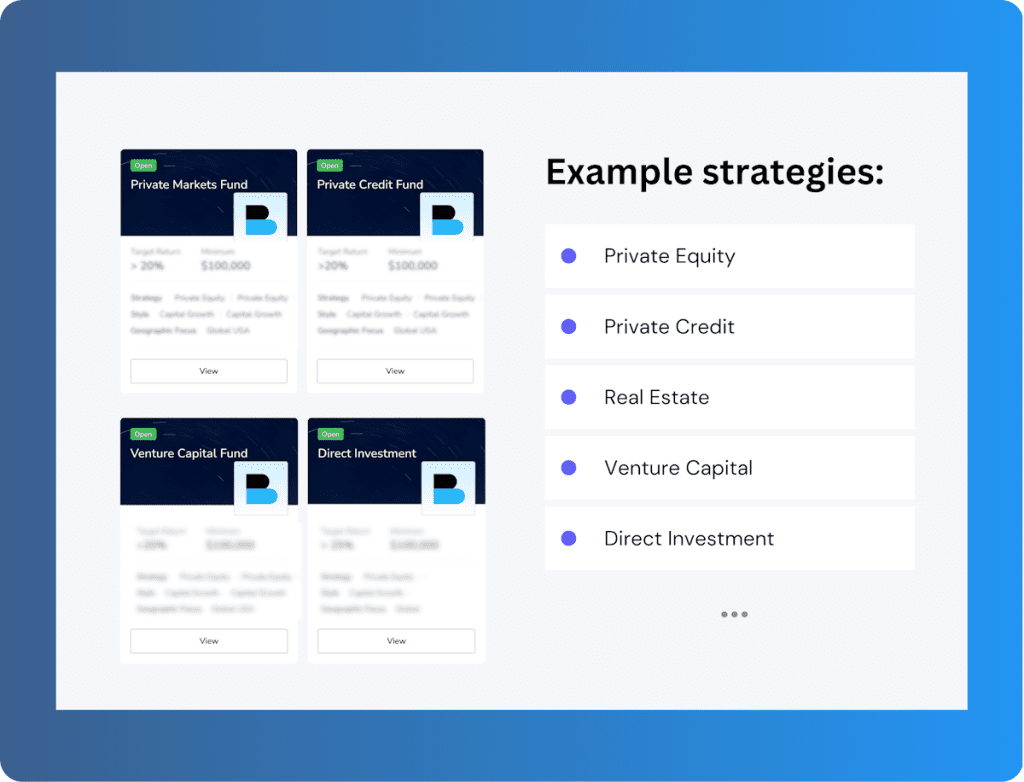

Through our Bite Wealth Universe investment hub, we offer investors the chance to access leading private equity sponsors’ funds, as well as direct deals across various sectors and industries, democratising opportunities typically exclusive to institutional clients, with entry starting from $100,000.

With the ability to select their own funds and deals, investors have the possibility to align investments with their interests and goals to capitalise on favorable market trends and investment themes.

Thematic opportunities

Diverse fund managers

Pre-IPO deals

Digital investment

experience

Register – quick and easy

01

Sign up and select your profile: investor, advisor, or sophisticated investor.

02

Invest online, request allocations, and sign subscription documents using our automated process.

03

Review due diligence materials and access key fund information with ease and speed.

04

Track investments & receive updates with a customized portfolio tool. Plus advisors can access one-click reporting.

Frequently Asked Questions

Bite continually strives to be the premium provider of alternative investment opportunities to High-Net-Worth investors and their advisers. The number and type of products vary so please register to see what is currently available. Typical investments can include private equity funds, private credit funds, venture capital funds, real estate funds and hedge funds.

After registration, investors can click to “view” each manager’s profile to access comprehensive overviews, fact sheets, and any other details on the market the manager operates in, the team or even multimedia content such as videos or podcasts. If they find an opportunity that appears right for them, they can click “express interest” at which point Bite will connect them to the manager of their choice to start their investment journey on the underlying manager’s platform at which point they become the client of the manager of their choice, following their onboarding or investment requirements and processes.

Our Bite Wealth Universe hub is constantly growing as more and more investment firms join the platform. The minimum investments on the various opportunities that have been available so far, including opportunities from Bite Asset Management, range from $10,000 to $250,000.

Anyone can open an account with Bite provided they meet certain requirements regarding their knowledge, experience and access to suitable resources, as well as having met our AML/KYC standards. Bite is open to High-Net-Worth and Sophisticated Investors, and their advisers. This means we must ask you several questions to assess the suitability of our products to you. Advisers can open an account to see if any products are suitable for their clients provided their client’s meet the definitions of either a HNWI or a Sophisticated Investor. Fund managers can open an account as professional clients. Please learn more on who we serve here (hyperlink to who we serve page) or contact us on [email protected].

Bite will not offer investment advice. Part of the rigorous account registration process is to ensure only investors with a sound financial understanding of these investments can access them. Whilst we would like to open the alternative asset market up to everyone the risks involved require a minimum level of knowledge, experience and resource and the investment decision remains entirely yours.

When you sign up, the documents available will explain in more detail how funds are structured, how investments are selected, and the role played by Bite and its associated companies in selecting and managing them. Bite does not make recommendations on investments and expects you to conduct your own due diligence before investing and to seek independent professional advice where appropriate.

Bite can help you with technological and procedural queries and our sales support will assist you if your issue is not addressed in our in-platform Help Center. If you wish to get in touch with a team member, please contact us on [email protected].

Bite does not charge fees for the use of its platform and it is free to use for clients who have successfully been through the account registration process.

Fees are only incurred when you make an investment. The fees are typically: a one-off introduction fee and an annual investor servicing fee. Both fees are a % of the sum invested or assets under management (AUM). Bite reserves the right to determine the fee levels on a per product basis and reserves the right to change fee levels on future products.

The underlying fund fees usually involve a management fee and a performance fee. A typical premium private equity fund will charge a 2% management fee and a 20% performance fee. The performance fee is subject to a typical hurdle rate of 6-8% and represents the benchmark a fund has to reach before the private equity fund managers are entitled to their performance fee.

You should consider very carefully the offering documents, information memoranda, limited partnership agreements and other documents on the website relating to a specific investment as this will tell you about fees specifically applicable to that investment.

Bite charges fees on a per product basis. Standard fees include:

- Subscription Fee (a one-off fee charged as a percentage of the subscription amount)

- Management Fee

- 0% Performance fee (Bite reserves the right to charge a performance fee on a per product basis)