- Conventional wisdom holds that passive strategies typically outperform active strategies – however, private markets are generally reported to be an exception

- The active approach of private equity firms is different to that of public equity managers – it is about actively creating value alongside management of their investee companies, rather than just picking winning companies

- Fund managers select assets where they see the potential to fundamentally improve and even transform businesses, helping private equity consistently outperform public markets throughout different economic cycles

Throughout our recent series of articles explaining the advantages of investing in private markets, we have consistently highlighted the attractiveness of investing in private equity due to its reported consistent outperformance of the asset class in comparison to its public market equivalents.

This article examines this trend further by specifically looking at how private equity firms achieve such consistent results, introducing some of the tried-and-tested methods fund managers use to create value throughout their portfolios and, in turn, generate often strong returns for their investors in the process.

Differentiated active investment approach

When investing in public markets, decades of research and conventional wisdom suggest that a passive investment approach consistently beats active management, and at a better value from a risk-return perspective. That said, private markets are arguably the one area of investing where this often-cited adage does not hold true. Here are our thoughts on why:

In public markets, whilst top-performing active managers may be adept at identifying winning companies, ultimately none hold sizeable enough positions to hold management accountable or meaningfully influence strategy. Sure enough, they can liquidate their positions if they no longer believe their pick is destined to outperform. Proponents of passive investing often say that adjusted for fees, active public managers do not outperform index investors.1 In other words, it is not possible to generate alpha, and therefore investors better stick with passive investing. One look at recent volatility and we can see that neither investor – active or passive public – is however shielded from the beta impact and market overreaction.

How then, is private equity being reported as regularly its public equivalents (passive and active), and consistently at that? What is the secret sauce?

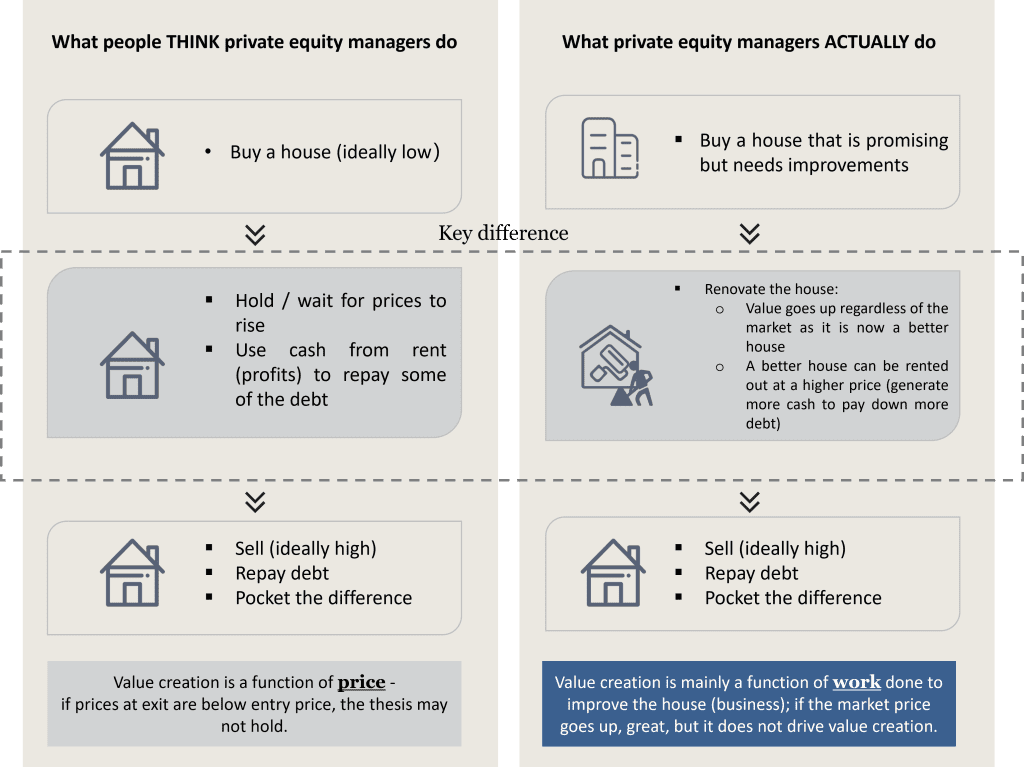

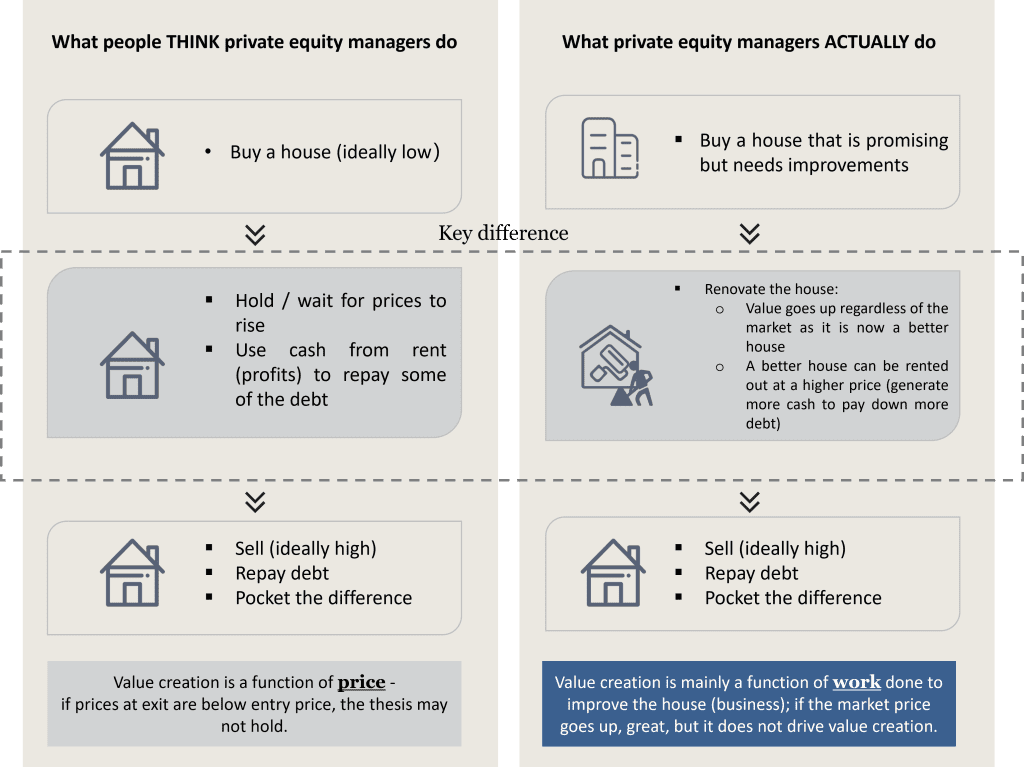

Before we dive into the specifics of value creation in private equity, it’s important to note that the active investment approach followed by private equity managers differs from their public counterparts. It does not stop with identifying companies that have the potential to outperform, and hoping that market forces agree and recognise their value with an increase in stock price over the selected time horizon.

Private equity managers often get accused of just waiting for market prices to go up, whilst adding leverage to generate the returns – this is not quite the case, especially for the top managers. Fundamentally, private equity value creation strategies are about growing and making existing companies better.

“ You don’t create value by just buying the S&P on leverage. You actually have to transform the company.” 2

—— Stephen Schwarzman, Chairman, CEO and Co-Founder of Blackstone

Instead of just holding investments and waiting for market conditions to dictate an exit, private equity houses take an active approach to improving their investments3 – a concept that can be easily demonstrated with the idea of renovating a house to create added value at exit, as shown on the easy-to-understand illustration below.

Figure 1: What private equity managers really do differs from what people think

Similarly, private equity GPs look to seek out businesses where they see operational improvement opportunities. Many have spent decades perfecting their private equity value creation playbooks and have experience finding sub sectors and niches where their expertise can make the biggest difference – to both the companies and their returns.

The public perception of private equity is also often that of cost-cutting, and laying off workers to achieve returns – that said, modern managers are much more focused on growth: developing new products, services, markets, hiring new talent, expanding production and even acquiring new businesses to grow both sales and earnings.

This approach to private equity value creation can often be more durable: making operational improvements to portfolio companies and then selling them at a higher value for investment returns is a more robust strategy than relying on clever deal structuring, leverage, and/or multiple arbitrage (i.e., buy low, sell high). In a worst case scenario, it also allows the manager to postpone a sale until market conditions are more favourable, without fear of the portfolio company imploding.

Whilst under certain market conditions, these latter techniques may generate attractive returns, if the market moves against assumptions, achieving the target return becomes more challenging. Due to the illiquid nature of the private equity asset class, managers cannot rely on probabilities of assumptions and scenarios materializing. Instead, an improved and better positioned portfolio company can command a higher exit value even if the market is in a recession so the investor is not dependent on market conditions.

So far so good, but does the data support these statements? Examining value creation attribution during the last financial crisis in 2008-2009, data on equity multiple on PE exits shows that strategic & operational improvements have indeed trumped both the impact from public markets as well as leverage.

The secret sauce: Tried and tested private equity value creation strategies

Making these operational improvements to create value in private equity requires extensive experience and capital: although the typical SME (many of which are family-owned), or even larger company, may well have experience in its particular industry or business, they would often not have the know-how or resources to make the breadth of operational improvements required on their own.

What gives private equity a notable advantage over rival asset classes is the fact that managers have control over their portfolio companies, allowing them to deploy a plethora of organic or inorganic avenues to work towards adding noteworthy value within the usual 5-year holding periods of their investments. This often translates to a higher exit multiple, even at times when markets are falling. That said, multiple expansion is not the key value driver – sales and EBITDA growth is.

This can be achieved both organically and inorganically (i.e., via acquisitions):

An example of an organic value creation strategy in private equity is the famous 100-day plan, where managers outline the most pressing steps the business should take to drive efficiency improvement and top-line growth as soon as the deal closes. This usually consists of a strict, detailed plan giving the existing management team an opportunity to demonstrate their skillset but, on the flipside, also means that if they can’t deliver the required results, the GP will invariably call upon its established network of experienced executives with deep-rooted sector knowledge, putting the right people in place to help the firm realise its investment vision.

The value-add of this approach cannot be stressed enough – given how long it often takes to replace underperforming senior management in public companies, the nimbleness with which private equity sponsors are able to move quickly and bring in experienced management teams from their network time and time again is one of the main reasons we believe private equity performs strongly.

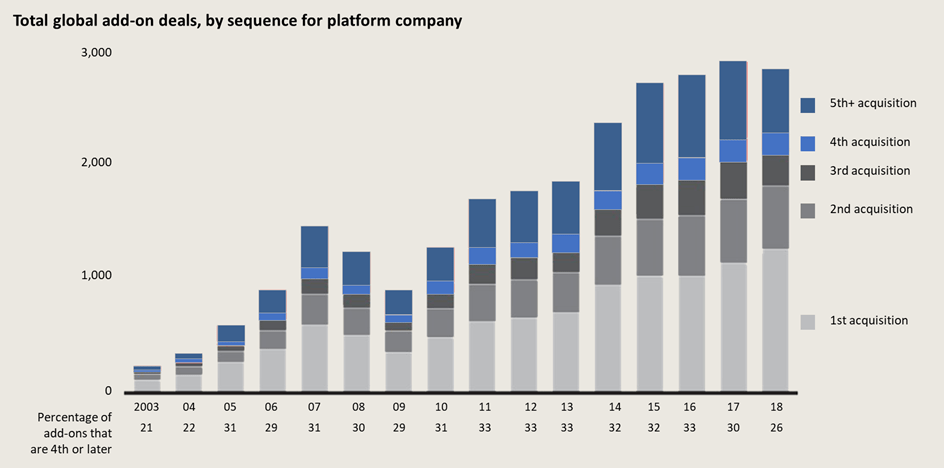

A popular inorganic value creation method would be to undertake a ‘buy and build’ strategy, acquiring complementary businesses to increase the footprint and capabilities of the investee company. Adopting this strategy can turn a local business into a regional champion or transform a once-regional business into a truly global outfit. This helps to explain why some businesses go through several rounds of private equity ownership and continue generating significant returns at each subsequent exit.

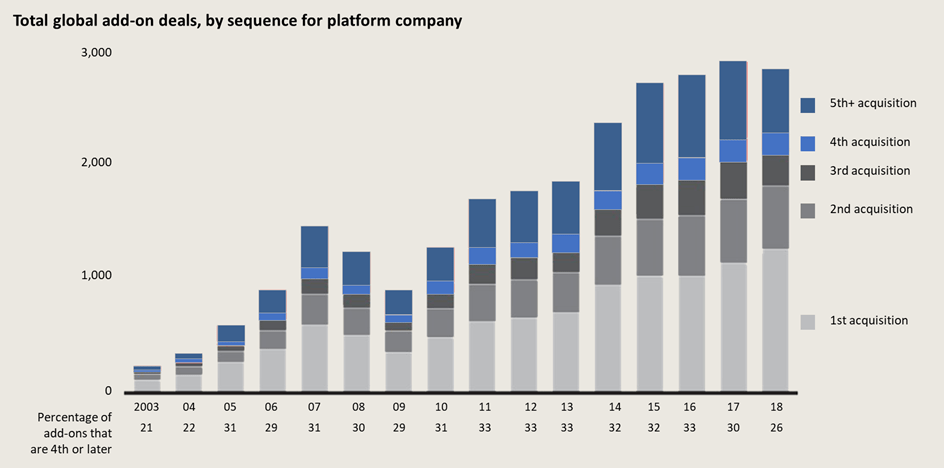

Note: Represents the year in which add-on was acquired

Source: Pitchbook Data, inc

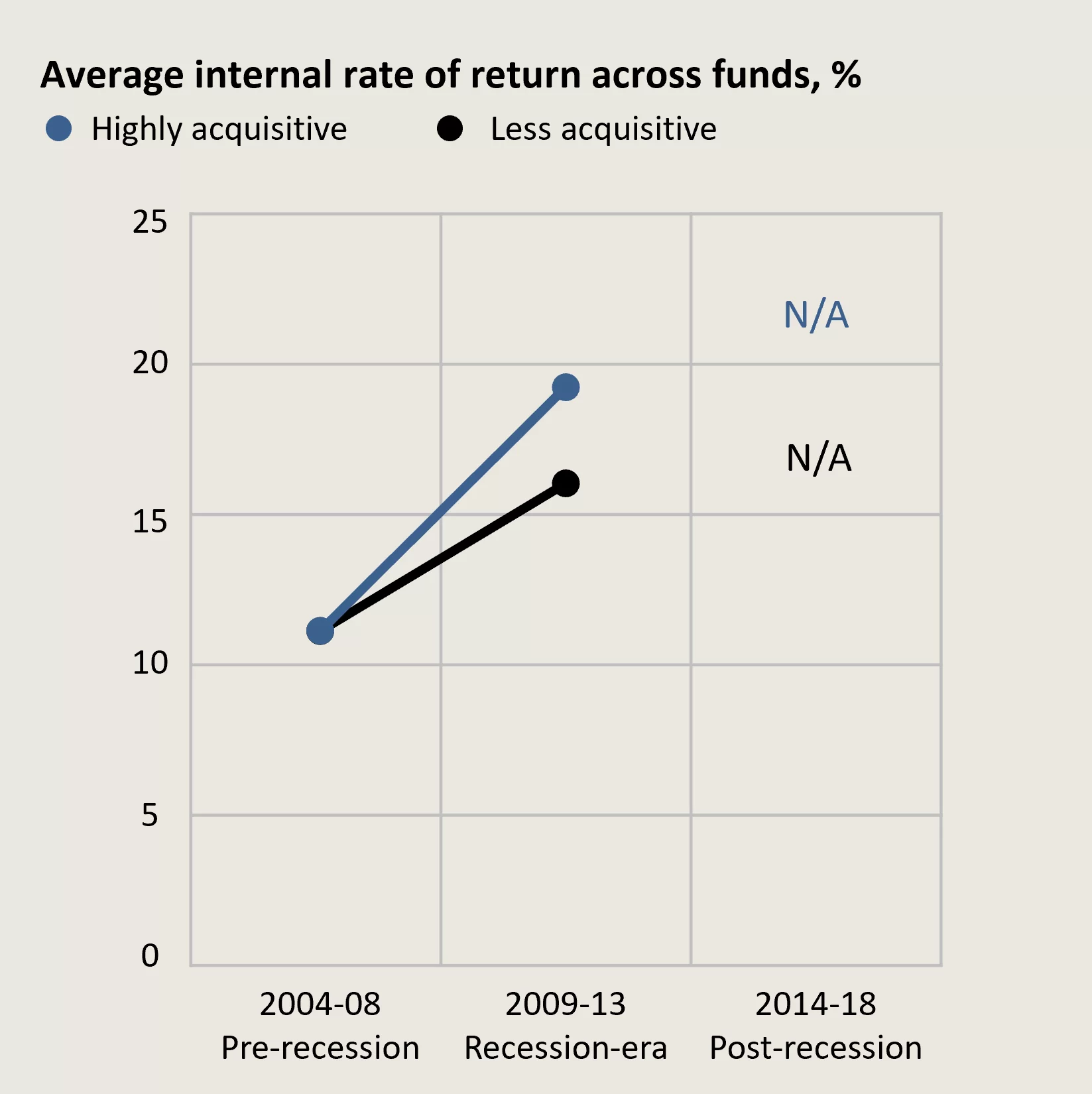

Figure 3 shows the growing popularity of buy and build deals. This method is often used during times of economic downturns due to the ability of private equity backed businesses to operate nimbly during unpredictable times. In fact, PE firms often take advantage of downturns to acquire their portfolio companies’ competitors at accretive (i.e., lower) multiples and thereby both strengthen their portfolio’s market positioning while also lowering their average entry multiple (often referred to as creation multiple).

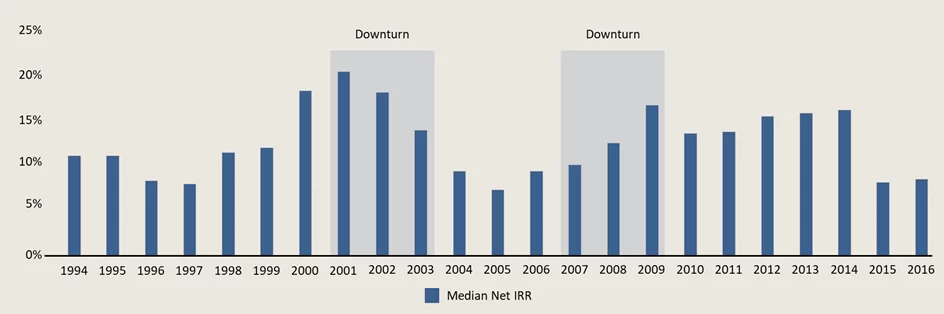

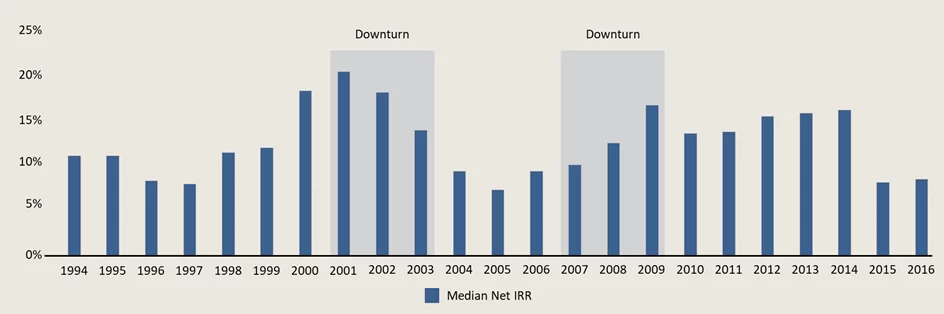

Source: Preqin

Indeed, Figure 4 adds more weight to this argument showing firms that were more acquisitive during a period of recession achieved a higher IRR across their funds, indicating PE managers active during this time period were rewarded for adopting a more front-footed strategy during unpredictable times.

As such, it is not surprising therefore, that fund vintages invested during recessions have performed exceptionally well.

Source: Cambridge Associates U.S. Buyout Index, as of March 2019, 2016 is the latest vintage available. For illustrative purposes only.

Decades of private equity value creation

We believe individuals who are considering investing in private equity investments, should focus on selecting PE houses with a proven track record of creating value throughout their portfolios during a mix of economic cycles. In our previous article, we discussed how the top quartile private equity managers have decades of experience producing leading returns, consistently outperforming their public market equivalents. Therefore, investors should ensure they obtain all the facts before making any investment decision in private equity.

“In my opinion, how private equity managers skilfully create value within their portfolios is what really makes this asset class stand out. The multitude of tried-and-tested value creation avenues at their disposal offers PE firms the ability to not only navigate a range of economic cycles but continue to enhance businesses and deliver impressive returns for their investors in the process.” Anna Barath said.

Sources:

- Morgan Stanley, A new take on the active vs. passive investing debate, (April 5 2022) (accessed in July 2022)

- EY, How can private equity transform into positive equity? (accessed in July 2022)

- Investments & Wealth Monitor, Private Equity Offers Resilience in a Downturn, (July/August 2020) (accessed in July 2022)

- EY, Taking stock – How do private equity investors create value (2014) (accessed in July 2022)

- Bain & Company, Buy-and-Build: A Powerful PE Strategy, but Hard to Pull Off, (February 25 2019) ((accessed in July 2022)

- McKinsey & Company, Lessons for private equity from the last downturn, (April 15 2020) (accessed in July 2022)

- Investments & Wealth Monitor, Private Equity Offers Resilience in a Downturn, (July/August 2020) (accessed in July 2022)

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Asset Management. The facts of this article are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Asset Management delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Asset Management, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect.

This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.