In the first of a series of introductory articles aimed at helping our readers gain a clearer understanding of the often-mysterious world of investing in private markets, we are analysing why investors across the globe are now choosing to invest in private equity, in comparison to public market equivalents, in search of consistently higher and sustainable returns.

Consistent outperformance

While the benefits of investing in private markets have often gone under the radar in comparison to their much more publicised public market rivals, extensive research shows how private markets, and in particular private equity, have consistently outperformed their public equivalents since the start of the 21st century.

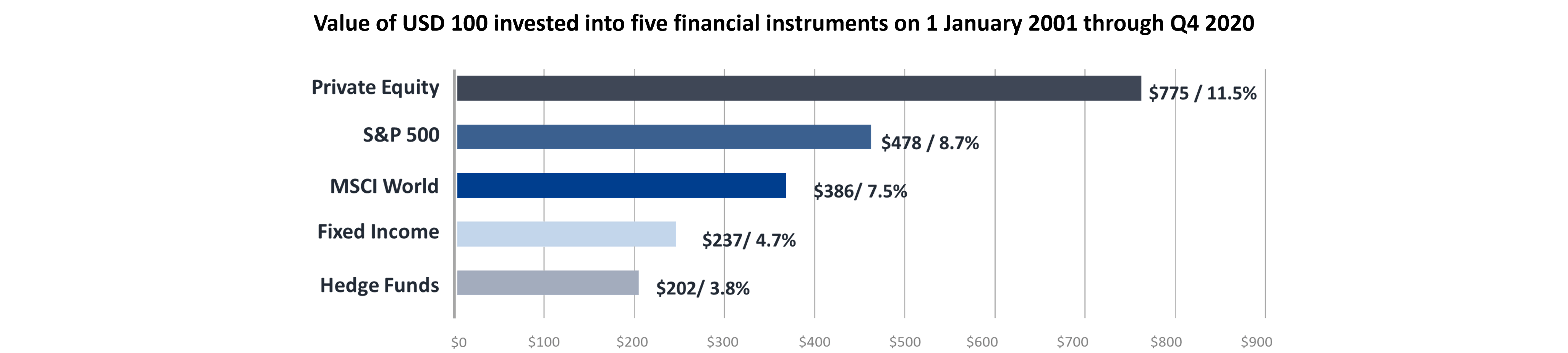

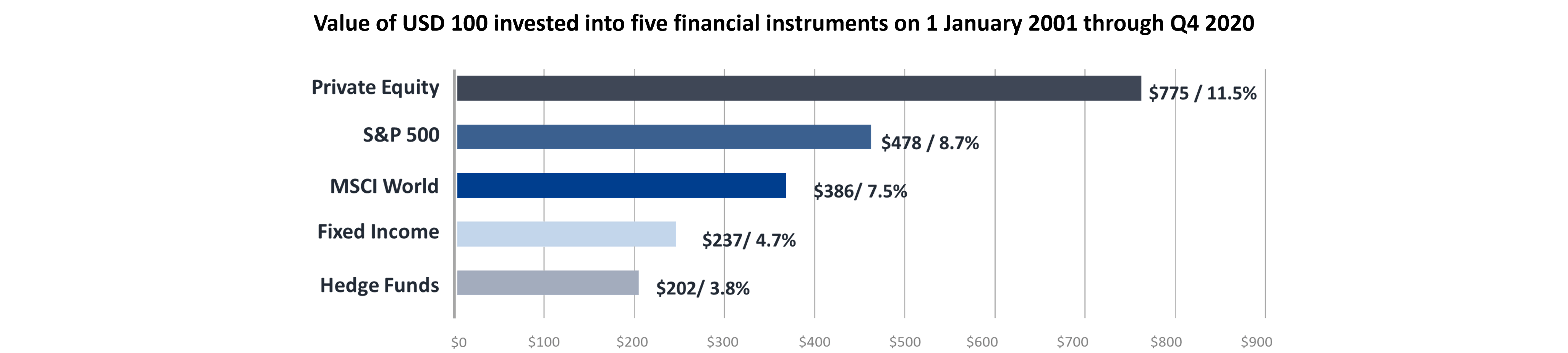

Figure 1: How global private equity has consistently outperformed various asset classes [1]

Value of USD 100 invested into five financial instruments on 1 January 2001. Private Equity: Burgiss; Fixed income; Barclays US Aggregated Bond index; Hedge funds: HFRI FOF Index; both MSCI World and S&P500 represent total return indices. Private Equity data sourced from Burgiss vintages 2002-2018,2,209 funds, and USD 2,399 billion in market capitalization. Private Equity strategies include: Buyout, VC (Late), VC (Generalist) and Expansion Capital. All dollar figures are USD. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future returns.

Figure 1 illustrates how global private equity has consistently outperformed various asset classes over the last two decades. $100 invested in private equity in 2001 would now be worth an impressive $775, compared to just $478 if you invested in the S&P500 over the same time period. This chart not only demonstrates the attractive returns which can materialise when investing in private equity but highlights the asset class’ ability to outperform equivalent classes throughout different economic cycles.

With such compelling empirical research indicating the persistent outperformance of private markets, we have highlighted a number of reasons below of why we see this data leading investors to come to the conclusion that private equity will continue to generate leading returns for the foreseeable future.

Volatile public markets

Given the ability to easily access public markets, it’s no surprise to see investors continue to select public market options despite the obvious drawbacks.

One of the major obstacles when investing in this space is the inherent volatility associated with public markets. This often leads to investors becoming fully exposed to unforeseen events – we only have to look at the last two years to see how dramatic events can instantly change the economic landscape – and while there can be big winners when public valuations fluctuate wildly, there are undoubtedly losers who will see their investments rapidly disappear.

Private equity, on the other hand, has indicated its ability to successfully weather, and indeed prosper, during uncertain economic climates. Following the Global Financial Crisis of 2008, private equity demonstrated its premium by bouncing back strongly and outperforming public markets in the following decade.

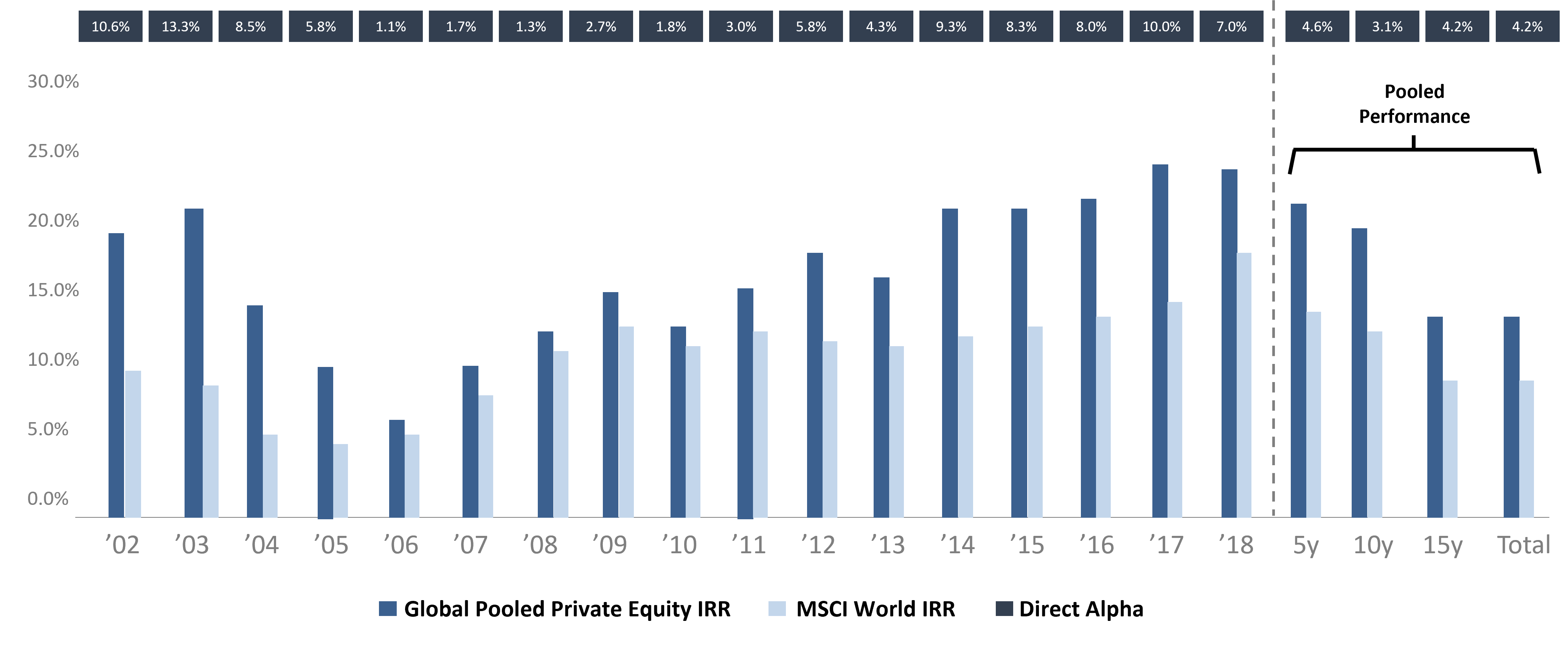

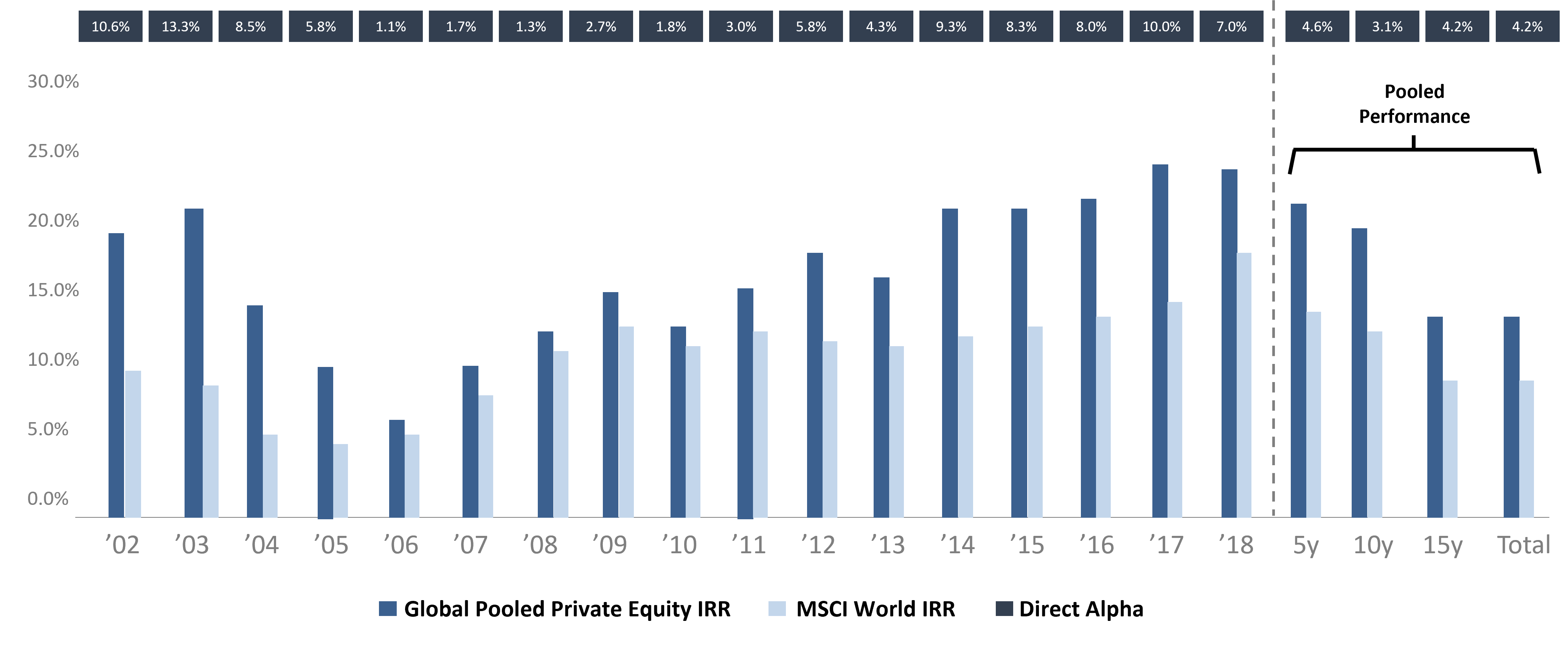

Figure 2: How private equity has consistently outperformed its public market equivalents (2002 – 2018)[2]

Global private equity fund pooled, absolute and relative performance against the MSCI World Index for 17 vintage years and 4 pooled aggregates – all in USD. MSCI World IRR is referred from the absolute performance and the direct alpha. Total is presentative of the since inception figures. Private Equity date sourced from Burgiss covers vintages 2002-2018, 209 funds, and USD 2,399 billion in market capitalization. Private equity strategies.

Indeed, Figure 2 shows how private equity has consistently outperformed its public market equivalents since the start of the 21st century and has maintained its advantage throughout different economic cycles, including recession years.

The one active investment approach that outperforms passive

Unlike public markets, experienced fund managers (GPs) are at the wheel of private market investments, identifying the most attractive available investment opportunities using their vast experience and deep-rooted sector expertise. In particular, private equity firms strive to create value through a number of avenues such as hiring talented management teams or identifying appropriate M&A opportunities for ‘buy and build’ growth strategies. Ultimately, the end goal is to find suitable buyers to successfully exit the businesses in their portfolios, generating the best possible returns for their investors.

A common misconception is that public markets would generate similar returns if they were held for a comparable length of time. However, the ability of private markets to create real value in the investment cycle is a key point of differentiation when comparing against public markets’ returns. When investing in private markets, you have an experienced manager steering the investment, committed to fostering growth within each investment and, in turn, securing the best possible returns for their investors.

Another fallacy about investing in private equity is the expectation that volatility in this asset class should be considerably higher than that of public equity due to an increased exposure to leverage (debt). However, research[3] has dispelled this assumption and proved private equity volatility is approximately equal to that of public equity. There could be various reasons why this is the case but perhaps the most relevant is the fund managers’ ability to invest in fundamentally less risky companies with a capacity to sustain higher leverage which, in turn, drives profitability within the businesses. In conclusion, the private equity industry’s consistent ability to generate higher returns at the same adjusted volatility levels supports the sustained alpha outperformance potential of this asset class.

Leading firms with a winning formula

When looking specifically at private equity performance, generating successful returns is a well-established practice with numerous pioneers continuing to deliver market-leading returns with trusted formulas.

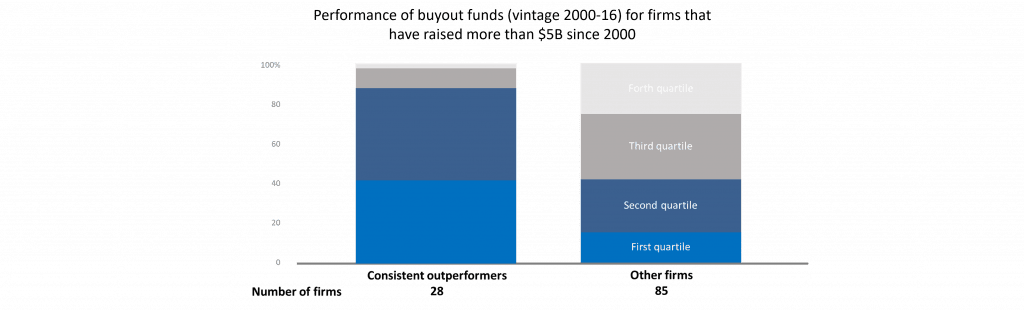

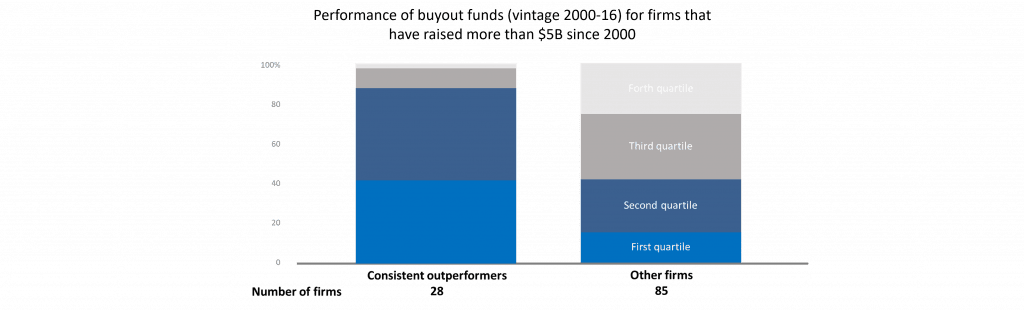

Figure 3: It is possible to consistently outperform in private equity (2000 – 2016)[4]

Note: Consistent outperformers defined as firms with at least 80% of their funds with 2000-16 vintages in the top two quartiles.

Source: Preqin; Bain analysis

Figure 3 highlights the consistent stellar performance of top quartile private equity firms. Data shows that the performance of top tier managers is persistent and therefore it has been possible to consistently generate outperformance by investing with the top managers. This not only provides more evidence for the outperformance private equity in general but also makes clear the importance of gaining access to and investing with an experienced private equity manager with a proven track record.

Conclusion

In summary, this article details how private equity has historically and consistently outperformed public markets over a considerable period of time but one valid criticism has been a limited and often restricted access to investing into private markets.

But this is changing and Bite Investments is at the forefront of the movement. We are helping individuals and wealth managers access private markets by removing the once-significant barriers to market entry, thus allowing a greater number of investors to reap the unquestionable rewards of investing in private markets.

Risk warning: Investment is restricted to professional, high net worth and sophisticated investors who can demonstrate that they have sufficient knowledge and experience to understand the risks of investing. Risks include the potential loss of capital and limited liquidity. Investments are long term and it may not be possible to sell your investment prior to maturity. Past returns are not a reliable indicator of future performance.

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Investments. The facts of this white paper are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Investments delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Investments, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect.

This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.

Sources:

[1] Blackrock, On the Historical Outperformance of Private Equity, (July 2021) (accessed Mar 2022)

[2] Blackrock, On the Historical Outperformance of Private Equity, (July 2021) (accessed Mar 2022)

[3] The Journal of Alternative Investments, Private Equity and the Leverage Myth, (December 1, 2020) (accessed Mar 2022)

[4] Bain, Public vs. Private Equity Returns: Is PE Losing Its Advantage? (February 24, 2020) (accessed Mar 2022)

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Asset Management. The facts of this article are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Asset Management delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Asset Management, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect.

This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.