- There has been a clear trend over the last two decades of companies choosing to stay private for longer

- Private markets have grown and gained in credibility, allowing businesses to tap into a range of funding opportunities

- With companies of all sizes being reported to be choosing to stay private for longer, most of the global economy is private and is proportionally growing in size

- Investors in the public markets risk missing out on the exponential growth these businesses are being predicted to produce in the private markets

The recent difficulties companies have encountered when looking to go public have been well documented, leading to many business owners across the globe considering whether going public is the right option at all. However, what is often left unsaid, is that this is part of a much wider trend we have witnessed over the last two decades where businesses have been choosing to stay private for longer in order to tap into further value creation possible in the private markets.

In our latest article, we wanted to take the opportunity to discuss why more companies are choosing to stay private for longer and to break down the implications for investors when assessing investment opportunities both in private and public markets.

Smaller companies now staying private

Traditionally, companies across the globe have transitioned from private to public markets to attract the investment they require to enhance future growth. However, in recent times the shine is beginning to wear off the prospect of going public due to numerous high-profile flops. So much so that last year saw a jaw-dropping decrease of 45% in IPOs taking place across the world1.

It would be easy to conclude this is a temporary phenomenon caused by the economic volatility of the last couple of years following a global pandemic. However, if you look a little closer, this is part of a much wider trend since the early 2000s of smaller businesses across the globe shunning public markets in favour of remaining private.

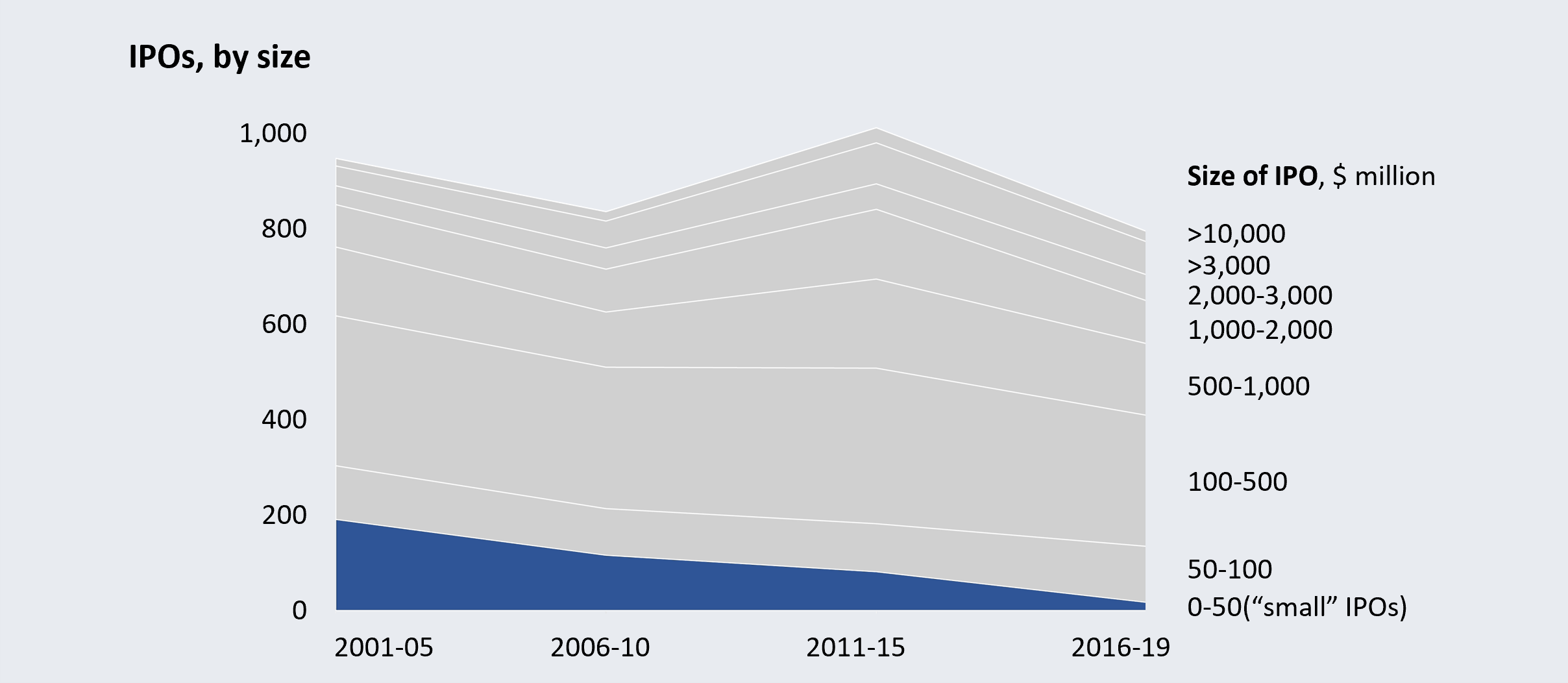

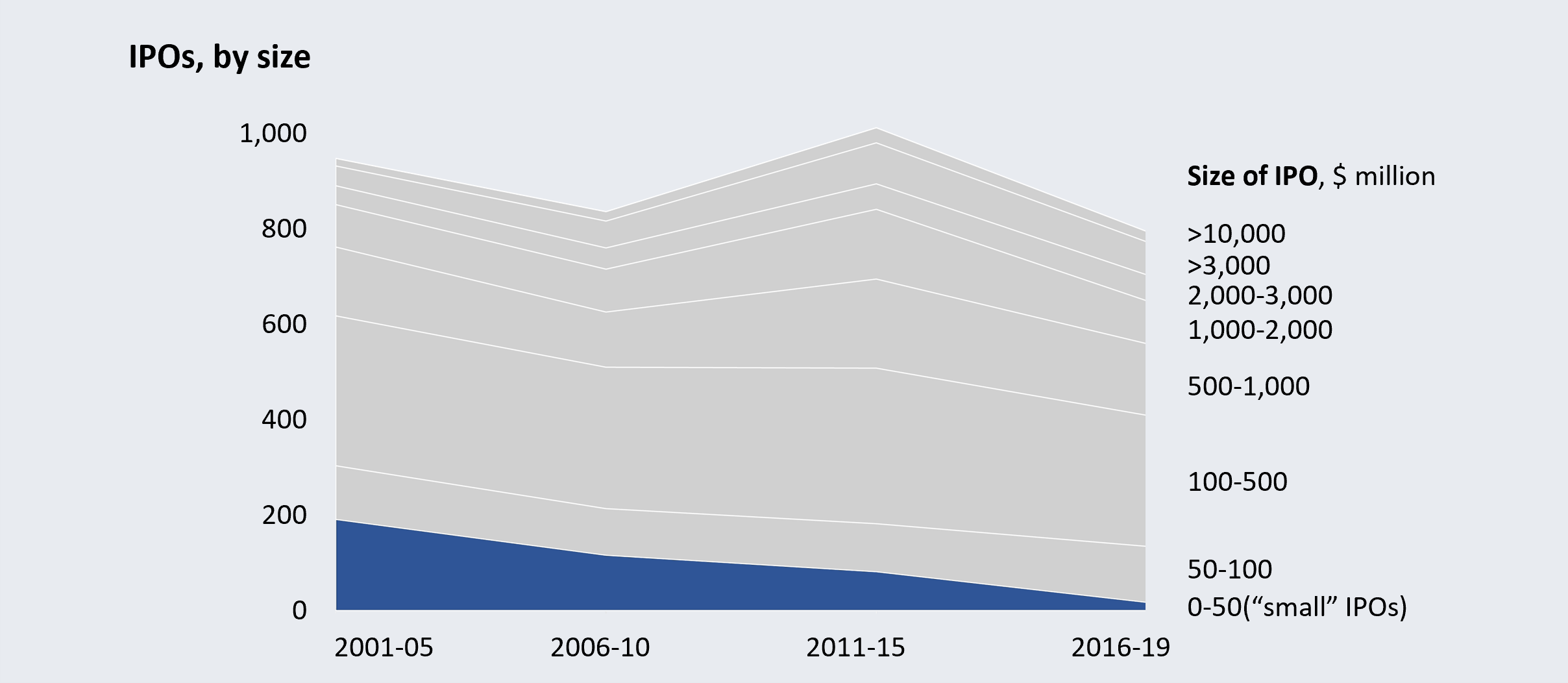

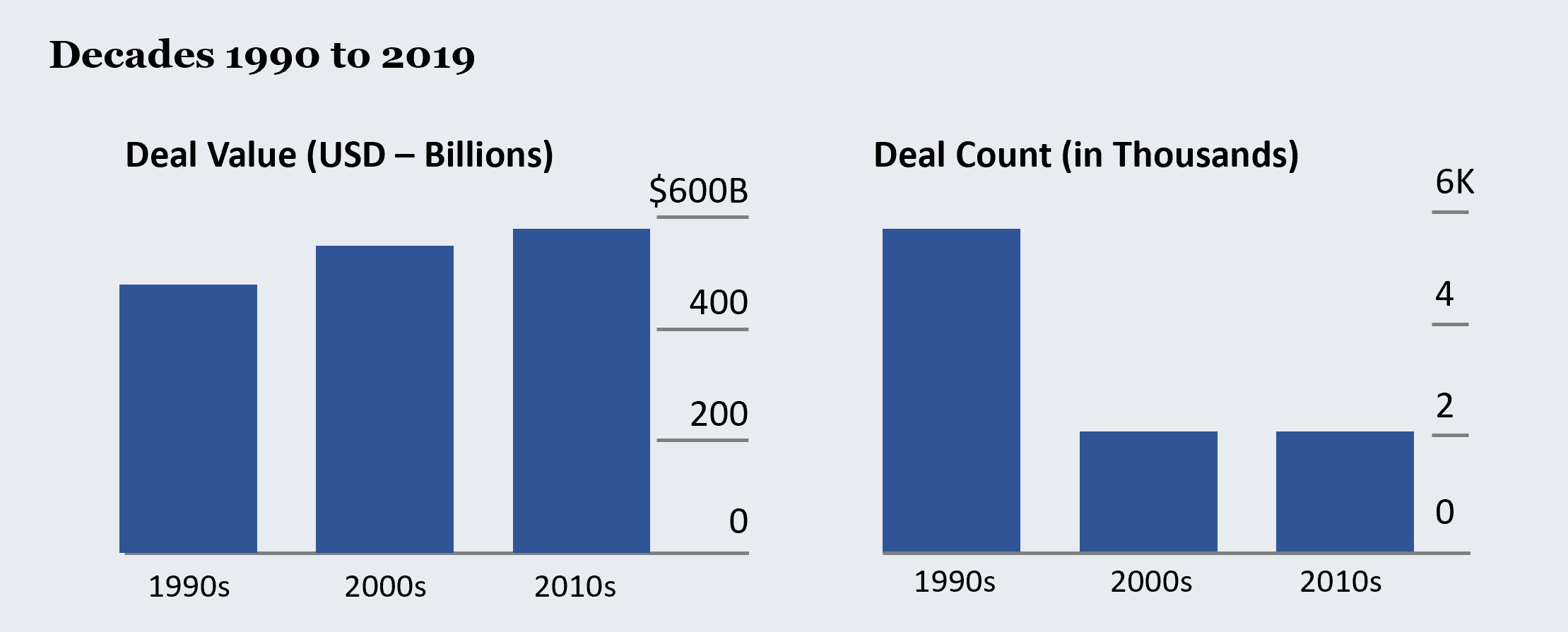

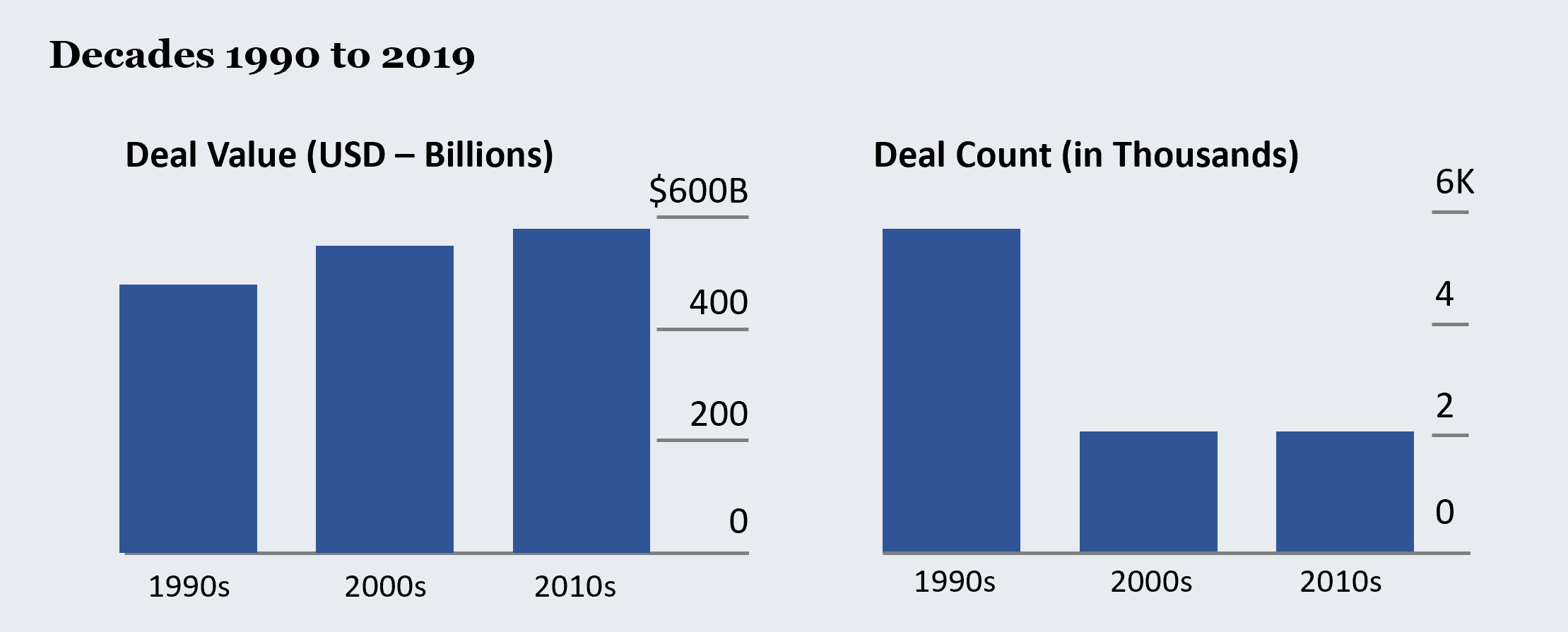

Emphasising this point, Figure 1 below highlights how there have been gradually fewer smaller IPOs (between $0-50m) taking place each year since 2000 while the much larger IPOs have largely remained stable. Meanwhile, Figure 2 highlights that while the deal value of US IPOs has marginally increased since the 1990s, the number of IPOs has dramatically decreased in recent years.

The implication here is that smaller companies no longer require an IPO to continue their growth journey, making investors in the public markets now more likely to miss the upswing in exponential growth these smaller businesses are set to experience.

Figure 1: There are fewer “small” IPOs now 2

Source: S&P Global; Corporate Performance Analytics by McKinsey

Figure 2: IPOs priced on US exchanges3

Source: Bloomberg Law as of January 4, 2020. Priced Initial Public Offerings of >$1 million, listed on a US stock exchange during the time period indicated.

Interestingly, many companies are now choosing to return to private ownership after poor performance in the public markets4. As an example, Weber Inc. decided to move back to the private markets in 2022 for just $8.05 a share, notably well below the $14 IPO price it achieved the previous year. Many expect this trend to continue as companies shun the public markets and turn to private ownership in an effort to create value and drive future growth.

Alternatives - not so alternative anymore?

The idea of a privately held company conjures up images of small businesses. However, according to Forbes, less than one percent of the 27 million companies in the United States are publicly traded. Furthermore, of the US firms with 500 or more employees, 86.4 percent are privately held companies5. In fact, as we can see, not only are all privately held companies not small, actually most of the economy is private.

So how do investors then benefit from the growth happening in what is the largest part of our economy? As we’ve detailed throughout our series of educational articles, private markets have become increasingly accessible to high-net-worth investors and are no longer exclusively reserved for the established, institutional players. This has helped fuel the remarkable growth private markets have experienced since the start of the 21st century, to the point where ‘alternative’ investments may not be so alternative anymore. In fact, large asset managers such as BlackRock6, Goldman Sachs7, Morgan Stanley8 and others are now recommending a sizeable inclusion of private markets into investor portfolios. As they argue, investors risk missing out on a key return component and potentially risk missing their investment objectives by not including private markets in their diversified portfolios.

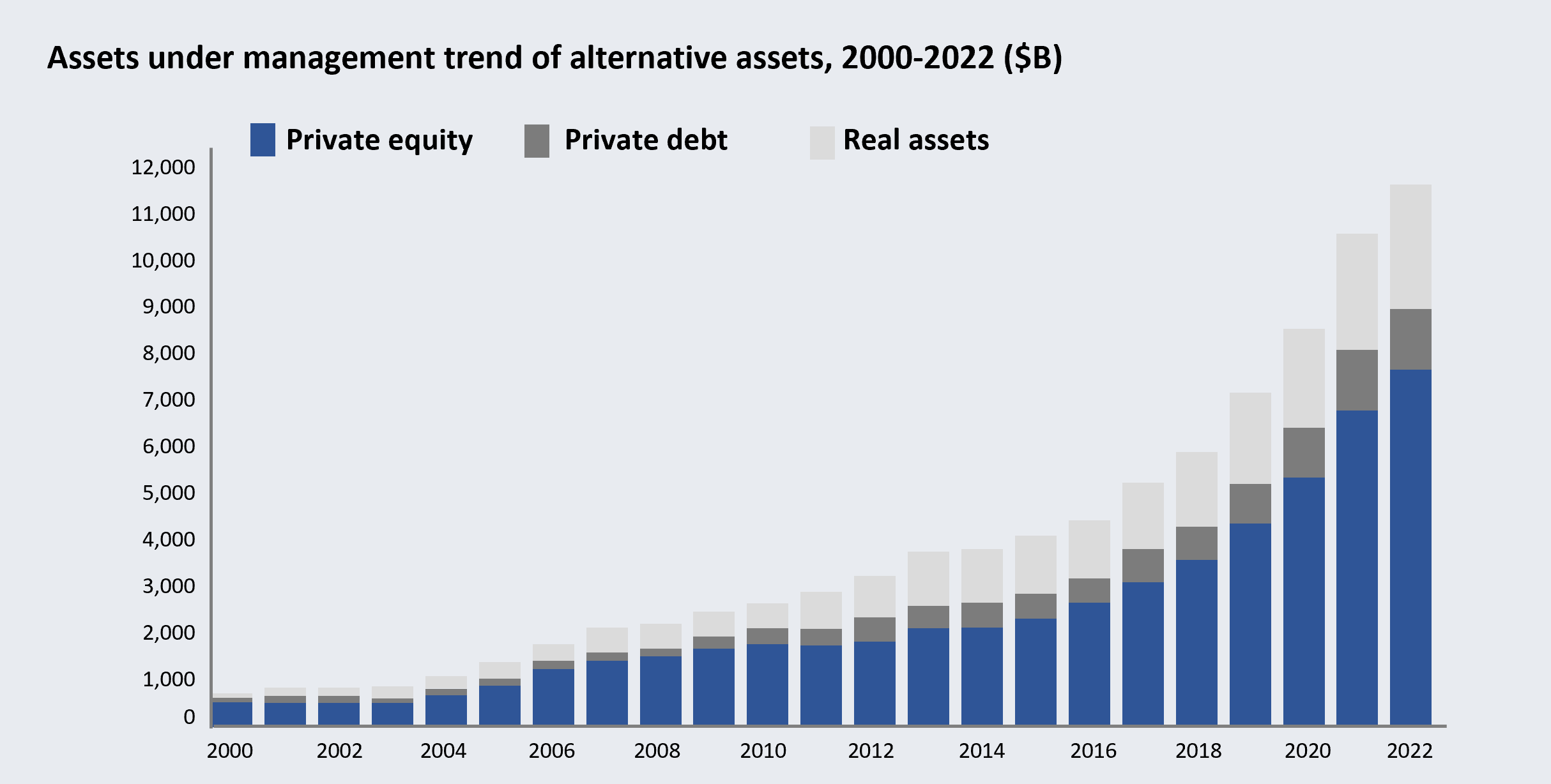

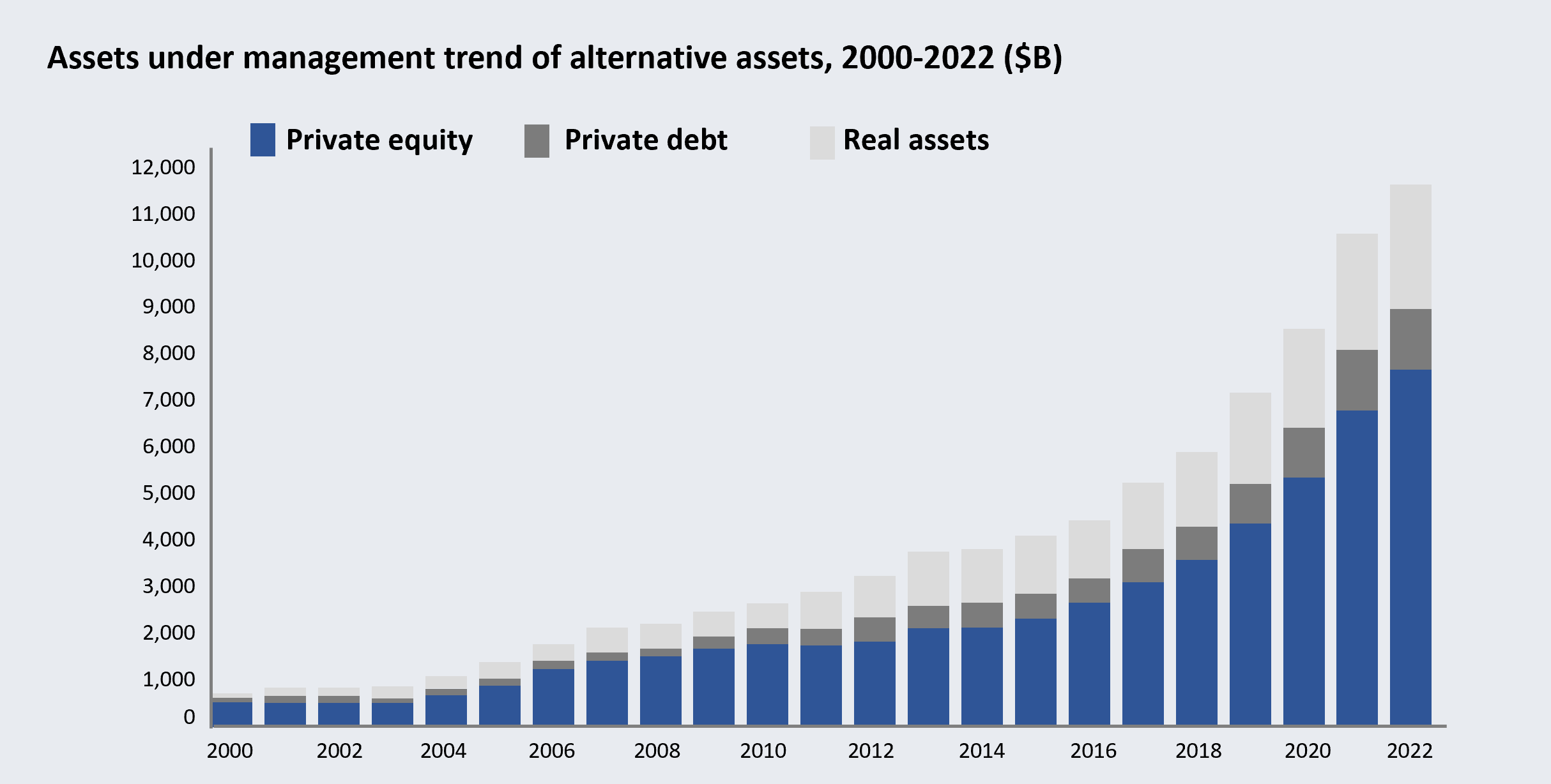

Figure 3 below highlights that private markets have achieved exponential growth over the last decade with just under $3 trillion AUM in 2010 increasing to a staggering $11.7 trillion in 2022. By way of comparison, the total capitalisation of the global public equity markets was estimated at $101 trillion as at Q4 2022 by the Securities Industry and Financial Markets Association9.

Figure 3: The gradual growth of private markets gained momentum during the pandemic 10

Source: Preqin Pro.

With the amount of capital flooding the private markets set to increase even further (the global alternatives AUM is forecast to at least double by 2026, potentially exceeding $23 trillion11), it’s no wonder that business owners now feel more comfortable staying private for longer. This is to capitalise on the plethora of funding opportunities and, ultimately, continue to grow their businesses within the private markets.

Misperception of risk?

Historically, investing in the private markets has often been seen to be a riskier experience for investors due to a perception of the markets lacking in transparency and reporting obligations. However, this is now changing. Regulators globally are tightening reporting requirements12, forcing the industry itself to become more transparent, not least due to longstanding lobbying from the institutional investor community, spearheaded by organisations such as ILPA or Invest Europe. Alongside this, advances in technology which were supercharged by the need for the majority to work remotely during the global Covid-19 pandemic have brought about new software solutions. These digital tools have markedly improved reporting methods with instantaneous transparency, offering a wider pool of investors the necessary confidence to begin operating throughout these private markets.

Importantly, private markets have proven to be less volatile than public markets and continue to consistently outperform public markets, even in downturns, which we highlighted in our first introductory article on the private markets.

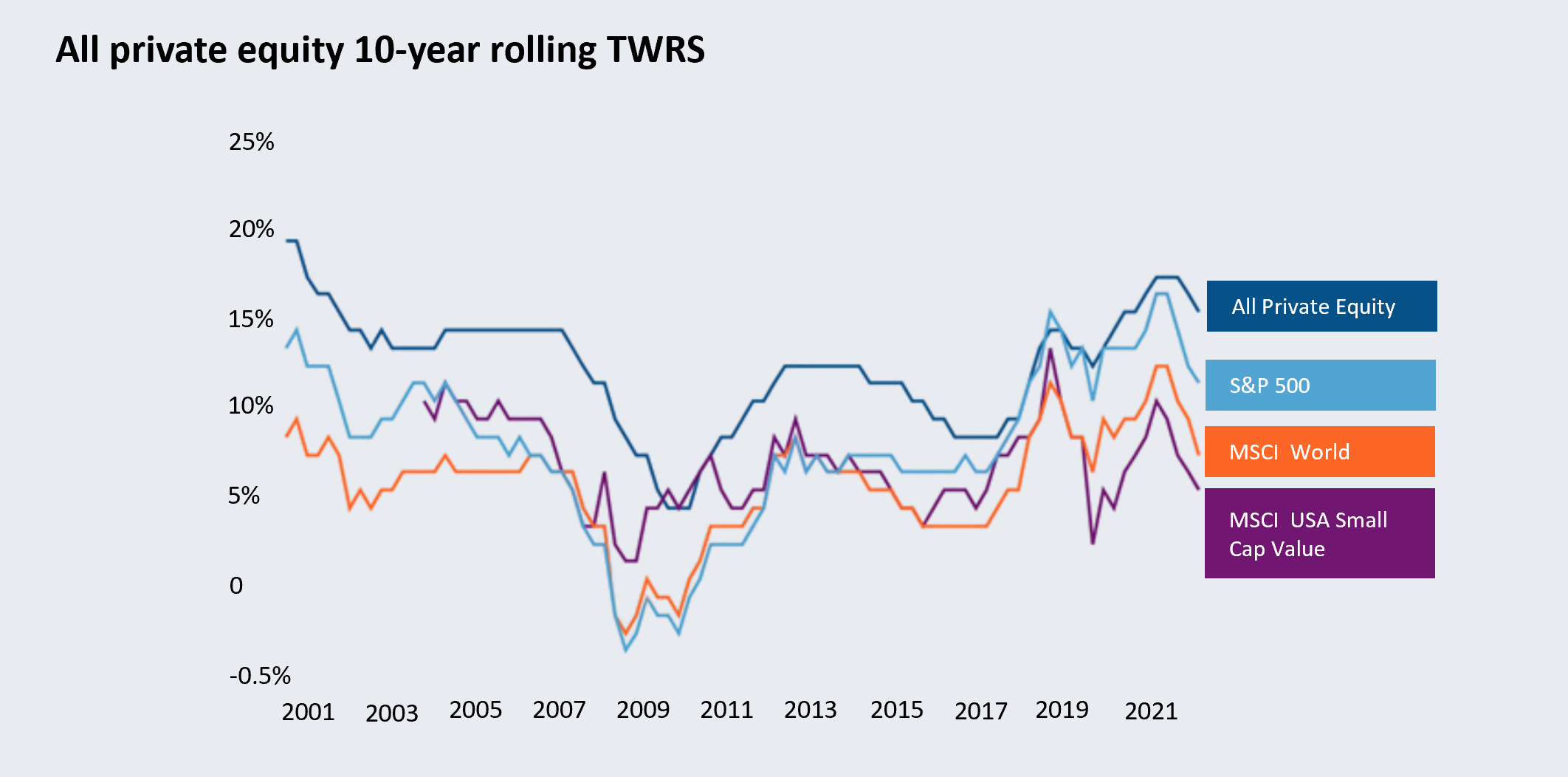

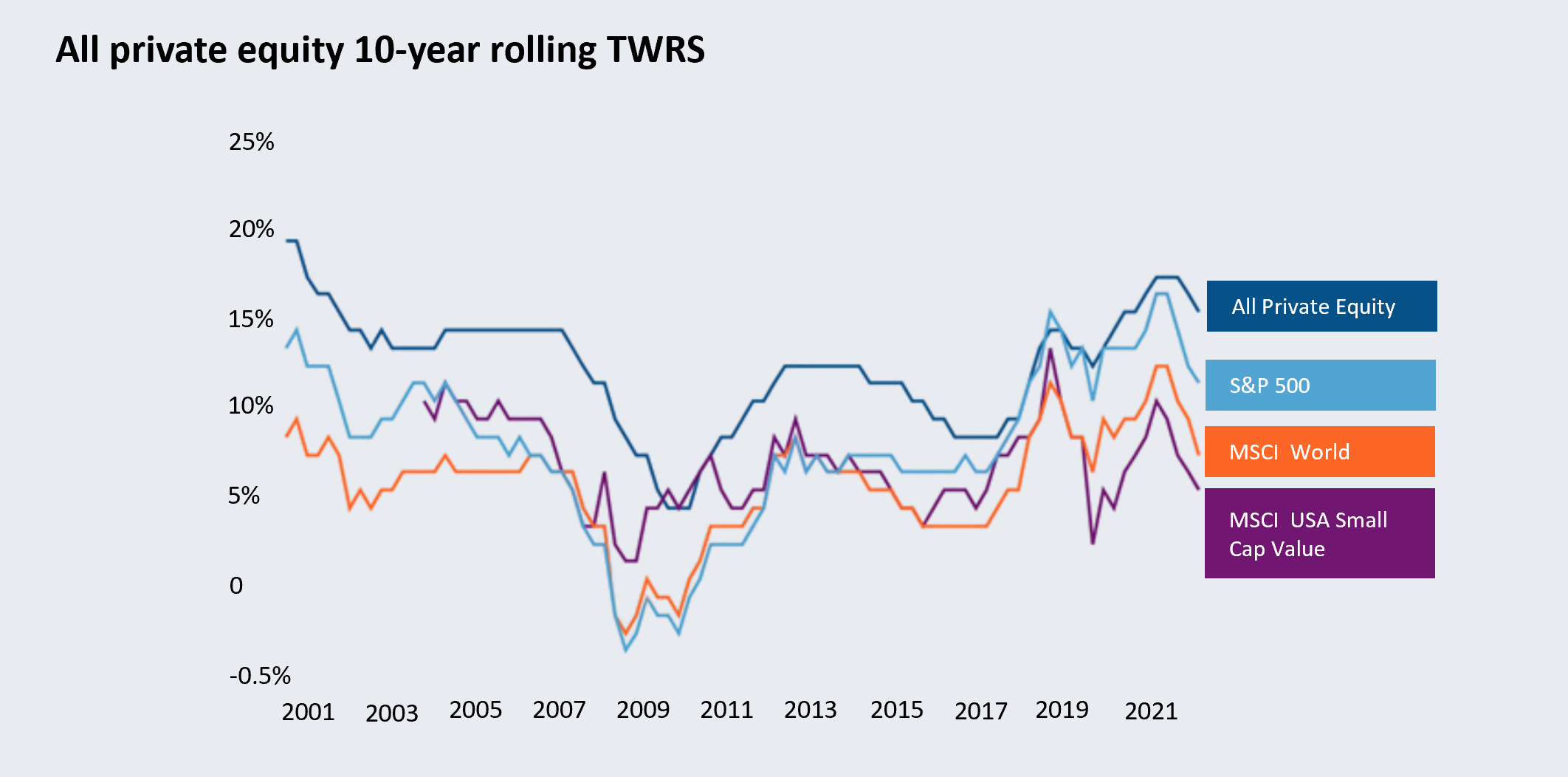

To emphasise the enduring performance of the private markets, Figure 4 below shows how global private equity has consistently outperformed public markets over the last two decades when comparing all private equity asset classes against the S&P500, MSCI World and MSCI USA Small Cap public markets.

Figure 4: All private equity 10-year time-weighted returns13

Furthermore, an array of investments options and vehicles to choose from throughout the private markets (from private equity to private credit and infrastructure) allow investors to balance their portfolios appropriately, helping to mitigate against any potential, unforeseen risk and also offer a degree of protection in inflationary periods.

In the past, there has been a misperception of risk due to relative unfamiliarity of the asset class from the part of investors. Private equity is often viewed as similar to the much more volatile and riskier venture capital industry but in fact, the companies private equity is backing not only tend to be established, profitable businesses but ones which are the backbone to any successful economy14.

That said, given that data points to private markets actually being less volatile and consistently performing better in downturns, and more investors becoming increasingly familiar with this asset class, this may be changing in the not so-distant-future. Again, this offers further comfort for businesses opting to not only stay but aspiring to grow within the private markets.

Passive investing no longer a safe bet?

The economic uncertainty of the last couple of years, coupled with rising interest rates and high global inflation, have had a massive impact on public equity markets and lead many to question the effectiveness of passive investing (the strategy of holding a broad market index, such as the S&P 500, as a long-term investment).

While passive investing remains a popular investment strategy in the public markets, the ‘set and forget’ approach no longer holds true to the extent it used to, leading to active managers outperforming passive managers for the first time in 202215.

With the uncertainty surrounding this once tried-and-tested public market strategy, investors are now more likely than ever to look to the private markets for potentially more predictable returns.

Private markets growing ever larger

With companies of all sizes being reported to be choosing to stay private for longer, most of the global economy is private and is proportionally growing in size. Staying private can allow these companies to tap into a myriad of funding and value-creation opportunities available that can result in turbocharge growth and enhance their value.

The freedom to create value is a key differentiator when trying to understand why businesses are choosing to stay private for longer and throughout our articles on the private markets we’ve highlighted tried-and-tested value-creation methods used by managers.

Conclusion

As always, investors need to carefully consider where to invest their capital; that said, ignoring opportunities available in the private markets may put investors at risk of overlooking a large part of the economy and missing out on the exponential growth and value these businesses have the potential to create.

Sources:

- EY: Global IPO Trend 2022, 2022

- McKinsey, Reports of corporates’ demise have been greatly exaggerated, October 2021

- Bloomberg Law, ANALYSIS: Three Decades of IPO Deals (1990-2019), January 2020

- Wall Street Journal, Going private again is all the rage among newly private companies, February 2023

- Business Review at Berkeley, Why Your Favorite Companies Are Privately Held, March 2022

- BlackRock, Rebuilding resilience in 60/40 portfolios, 2023

- Goldman Sachs, Is the 60/40 dead?, October 2021

- Morgan Stanley, Rethinking the 60/40 Portfolio, August 2022

- Sifma, Quarterly Report: US Equity & Related 4Q22, February 2023

- S&P Global, Private Markets: Still Waters Run Deep, April 2023

- S&P Global, Global alternatives AUM forecast to double by 2026, topping $23 trillion, January 2022

- US Securities and Exchange Commission, Remarks at The SEC Speaks in 2021, October 2021

- Hamilton Lane, The Truth Revealed: Private markets beats public markets – even after fees, May 2023

- Business Review at Berkeley, Why Your Favorite Companies Are Privately Held, March 2022

- Washington Post, The Future Looks Messy for Passive Investors, February 2023

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Asset Management. The facts of this article are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Asset Management delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Asset Management, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect.

This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.